The Periodical: 28th January 2022

Patience, some fundamental interaction, PMs and the humble moving average

Chart(s) of the Week

Round Up

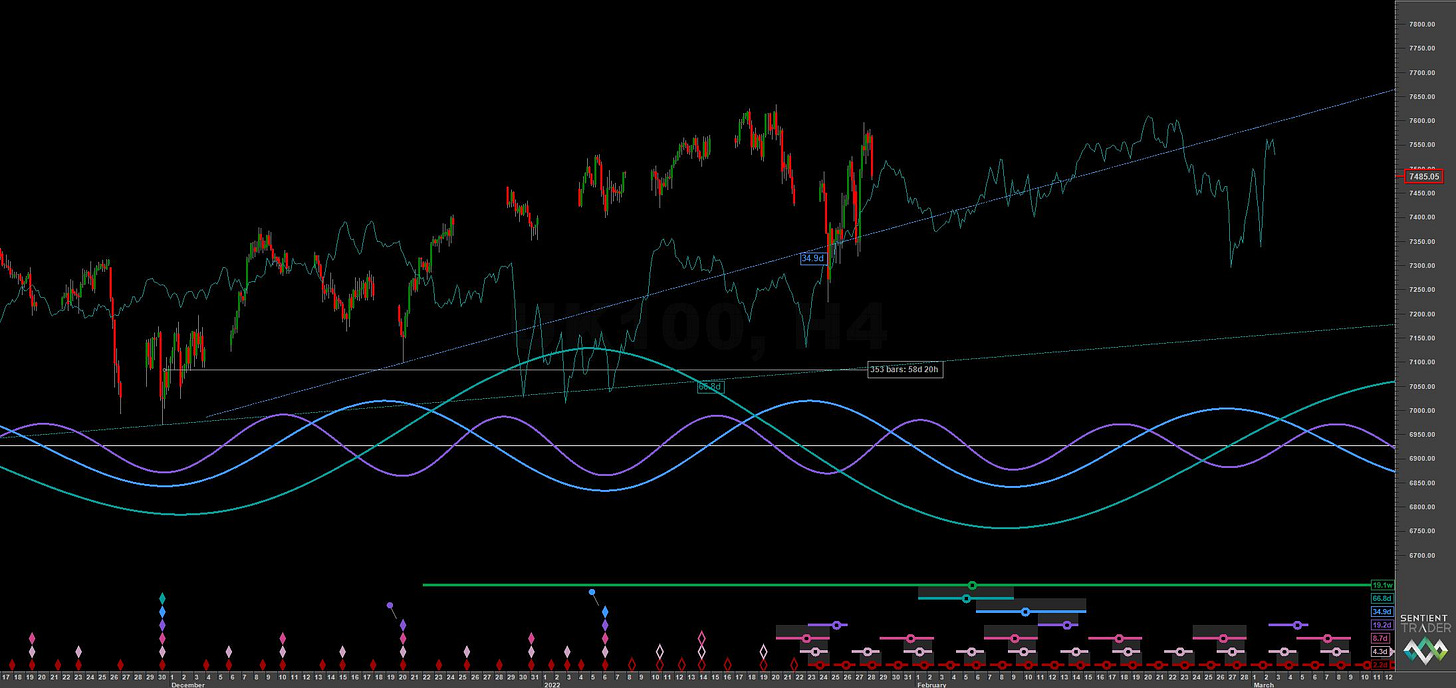

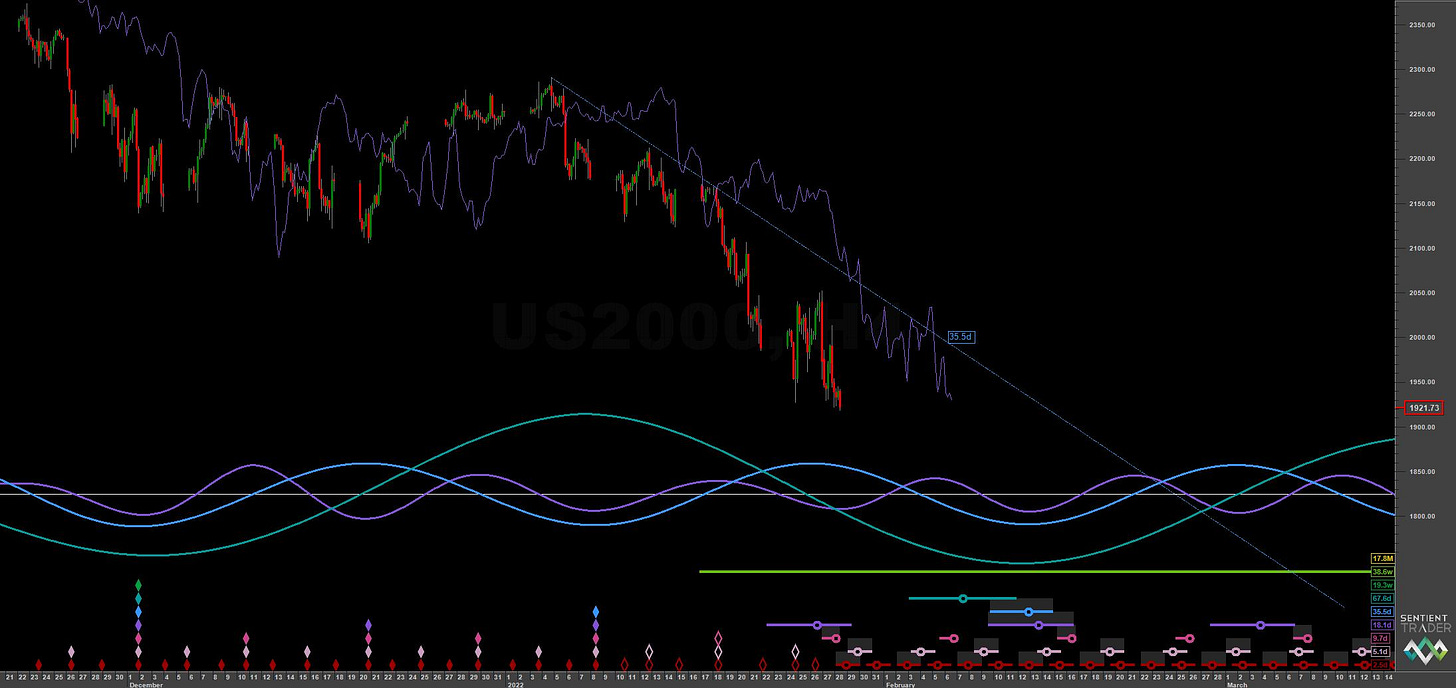

Following the crumbling of stockmarkets and the widely correlated crypto sector during the last couple of weeks we have been watching these markets resolve from what is phased as a 20 day nominal low in both sectors. Whilst most equity indices have formed fairly standard looking 20 day nominal lows here, the FTSE enjoyed a remarkably ebullient move, supported by the 80 day FLD. It will be fascinating to see if the increased amplitude is reflected on the downside in the coming weeks in the UK market. We will also begin to see whether the next 80 day nominal low in cryptocurrency is infact the 40 week nominal low, an outlier possibility. Expect a deluge of site updates in the next couple of weeks as we begin to approach these significant lows.

Gold and silver both continue to torment precious metal devotees, an 80 day nominal peak in recent days preceding a heavy retrace to the area of the recent 20 week nominal low. The next 80 day low in the PMs will have to display some extraordinary bullishness.

Of course strength in the dollar is part of the reason for the heavy fall in the PMs, undoubtably some fundamental interaction from the FOMC causing increased amplitude at the shorter frequency components. One benefit for us is to clarify the phasing in USDCAD and specifically the placement of the most recent 80 day nominal low.

Finally, if you haven’t checked out the first article on the use of moving averages please do! We will be posting more on this kind of numerical analysis in future articles. Although rudimentary, the MA is readily available for most readers to experiment with and will lead to a greater insight into useful signal processing techniques.