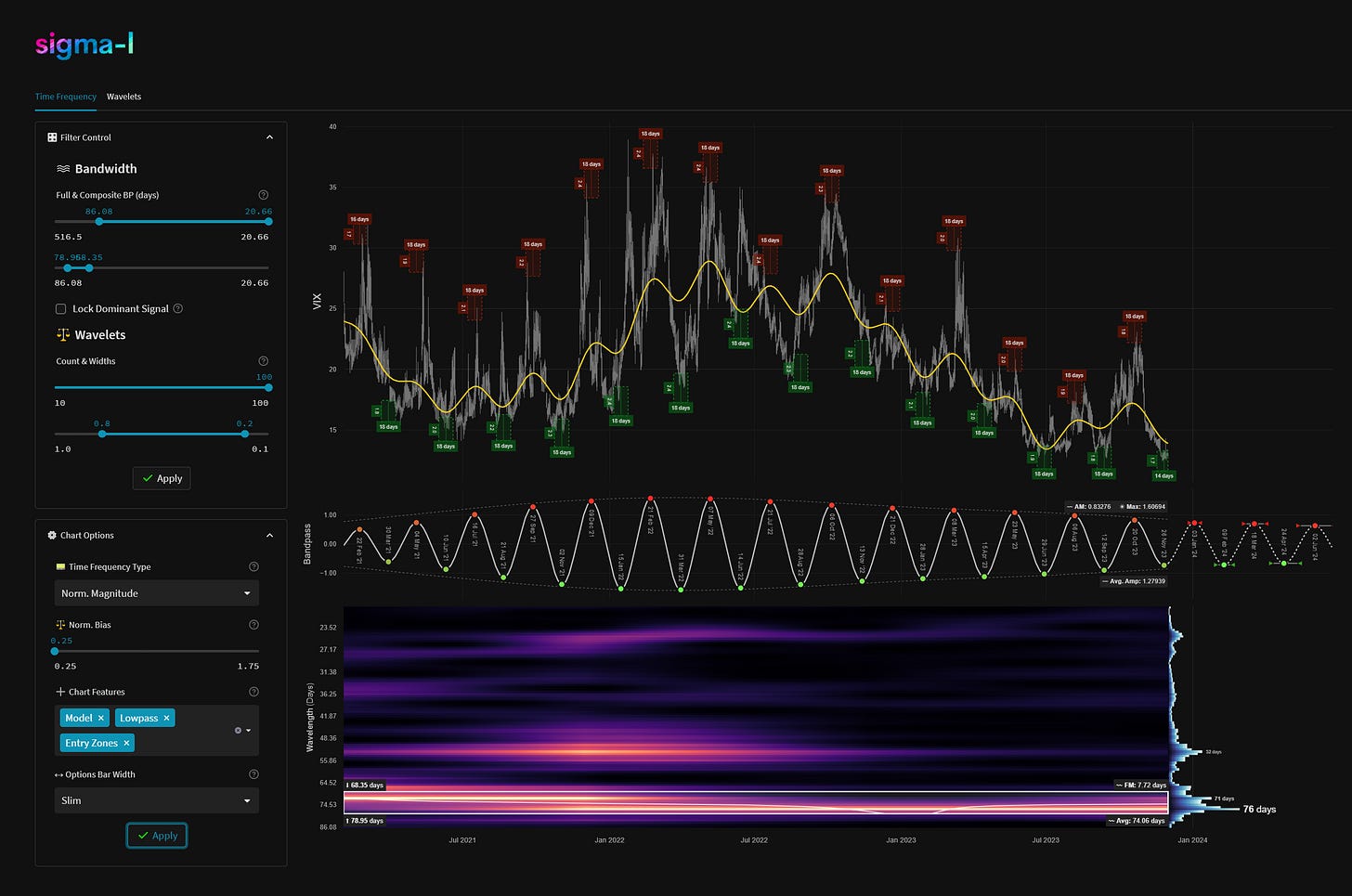

Sigma-L: Expert Market Cycles Insight

Sigma-L brings the power of modern signal processing techniques, with a nod to the insight of engineer JM Hurst, to retail traders, funds and institutions.

Expect a compact and frequent email newsletter format, covering major market turning points and penned by an expert in the application and design of signal processing software for financial markets.

Proposed robustly by pioneering engineer JM Hurst in the 1960s and 1970s, periodic motion in financial markets is often bewildering for the average trader. Although an attempt was made by Hurst himself to simplify the techniques to a totally practical level in the now rare Cyclitec Cycles Course, many new and enthusiastic students are often disconcerted with the mathematical foundation at the heart of this approach.

Today, innovations in software and signal processing techniques would have amazed Hurst, allowing a huge range of markets to be subjected to this kind of time-series analysis.

Our bespoke time frequency analysis allows the investor or trader to leverage the predictive power of periodic functions present in financial markets. The edge a trader or general investor can gain from a deep knowledge of these techniques will be indispensable.

Market Coverage

Core Instruments

In our core offering to paid subscribers we cover a wide range of instruments, enough for the vast majority of traders and investors today. Below is our current list, as of December 2023. Note, each instrument will also include reports on significant periodicities at varying wavelengths, the only qualifying criteria being quality of signal. For example the 80 day component, 20 week and so on:

Stockmarkets

US Stock Market Composite (DJIA, S&P 500, Russell 2000)

S&P 500

DAX

CBOE Volatility Index (VIX)

Metals

Precious Metals Composite (Gold, Silver, Platinum, Palladium)

Gold

Silver

Copper

Lithium

Steel

Zinc

Uranium

Forex

EUR Composite (EUR vs JPY/USD/GBP/AUD/CHF/CAD/NZD/HKD)

GBP Composite (GBP vs USD/EUR/AUD/CAD/JPY)

CAD Composite (CAD vs USD/EUR/GBP/JPY)

JPY Composite (JPY vs GBP/EUR/CAD/AUD/USD)

Dollar Index

Cryptocurrency

Crypto Composite (Bitcoin, Ethereum, Litecoin, Solana, Monero)

Bitcoin

Energy

US Natural Gas

WTI Crude Oil

Commodities

WisdomTree Agriculture Composite (AIGA, AGAP)

Wheat Futures

Founding Members

Subscribers who have upgraded or purchased founding member status are permitted to request one extra bespoke time frequency analysis per month on any instrument data is available for. For example, you may wish to compare the performance of TSLA against the core stock market composite, or perhaps you have a particular eye on a gold mining ETF that is closely correlated to the gold spot price in the core offering. This will be a single shot analysis that conforms to our usual format, crucially featuring our interpretation, defining time based targets and examining the bandwidth of interest for you. For example you may wish to examine the bandwidth of 200 days and lower in uranium ETF URA, or perhaps 100 days and lower in energy ETF XLE. Think carefully about which instrument you wish to request, many individuals stocks and ETFs are highly correlated to the core instruments, only differing by individual amplitude (variance or volatility). If you think you have found an instrument that diverges, spectrally, from the core offerings it may well be an excellent candidate for our time frequency microscope!

Importantly, all founding member request analyses will also be sent to all other founding members, who may find it useful to examine a particular focused time frequency report. This gives significant added value for founding members.

Please ask us for this bespoke analysis if you are a founding member, ideally via a DM on X (@tradinghurst).

In all cases subscribers are emailed the moment a new post goes live with our time targets and ranges clearly defined, in line with our time frequency analysis.

Our Software and Techniques

Our analysis is now given mainly via the microscope of an unbiased time frequency analysis. For more details on this technique please check out our article: Hacking the Uncertainty Principle: Time Frequency

DISCLAIMER: This website/newsletter and the charts/projections contained within it are intended for educational purposes only. Results and projections are hypothetical. We accept no liability for any losses incurred as a result of assertions made due to the information contained within Sigma-L. This report is not intended to instruct investment or purchase of any financial instrument, derivative or asset connected to the information conveyed in the report. Trade and invest at your own risk.