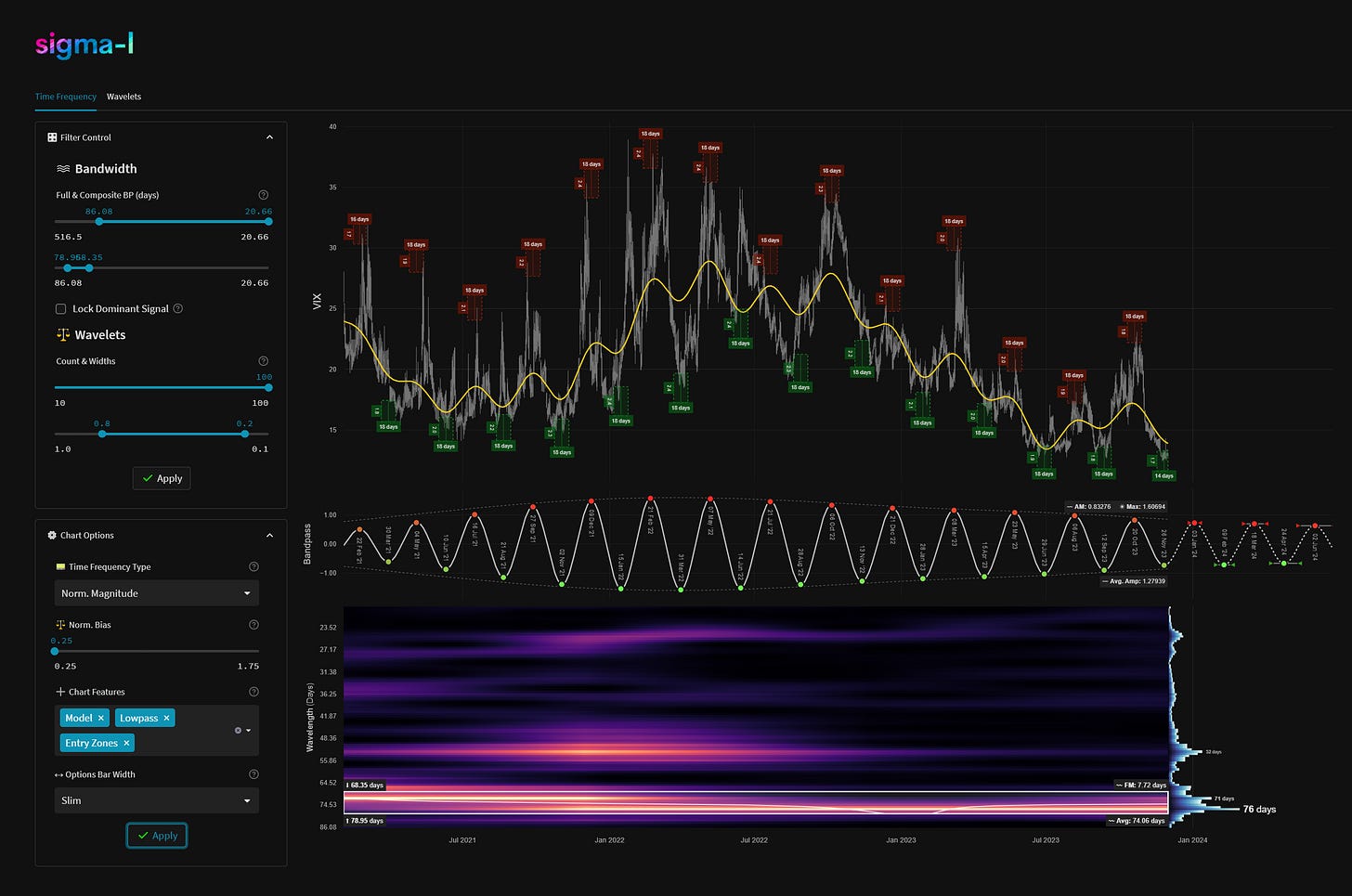

Sigma-L: Expert Market Cycles Insight

Sigma-L brings the power of modern signal processing techniques, with a nod to the insight of engineer JM Hurst, to retail traders, funds and institutions.

Proposed robustly by pioneering engineer JM Hurst in the 1960s and 1970s, periodic motion in financial markets is often bewildering for the average trader. Although an attempt was made by Hurst himself to simplify the techniques to a totally practical level in the now rare Cyclitec Cycles Course, many new and enthusiastic students are often disconcerted with the mathematical foundation at the heart of this approach.

Today, innovations in software and signal processing techniques would have amazed Hurst, allowing a huge range of markets to be subjected to this kind of time-series analysis.

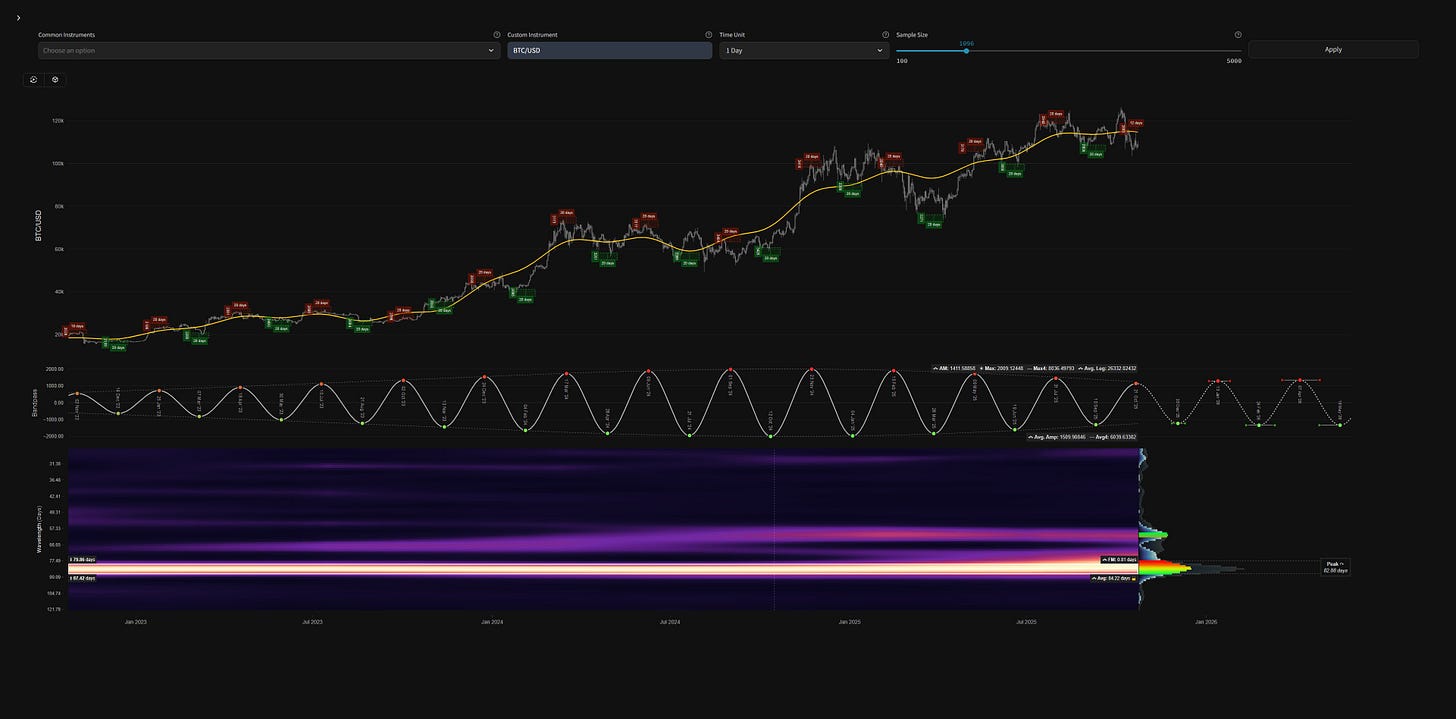

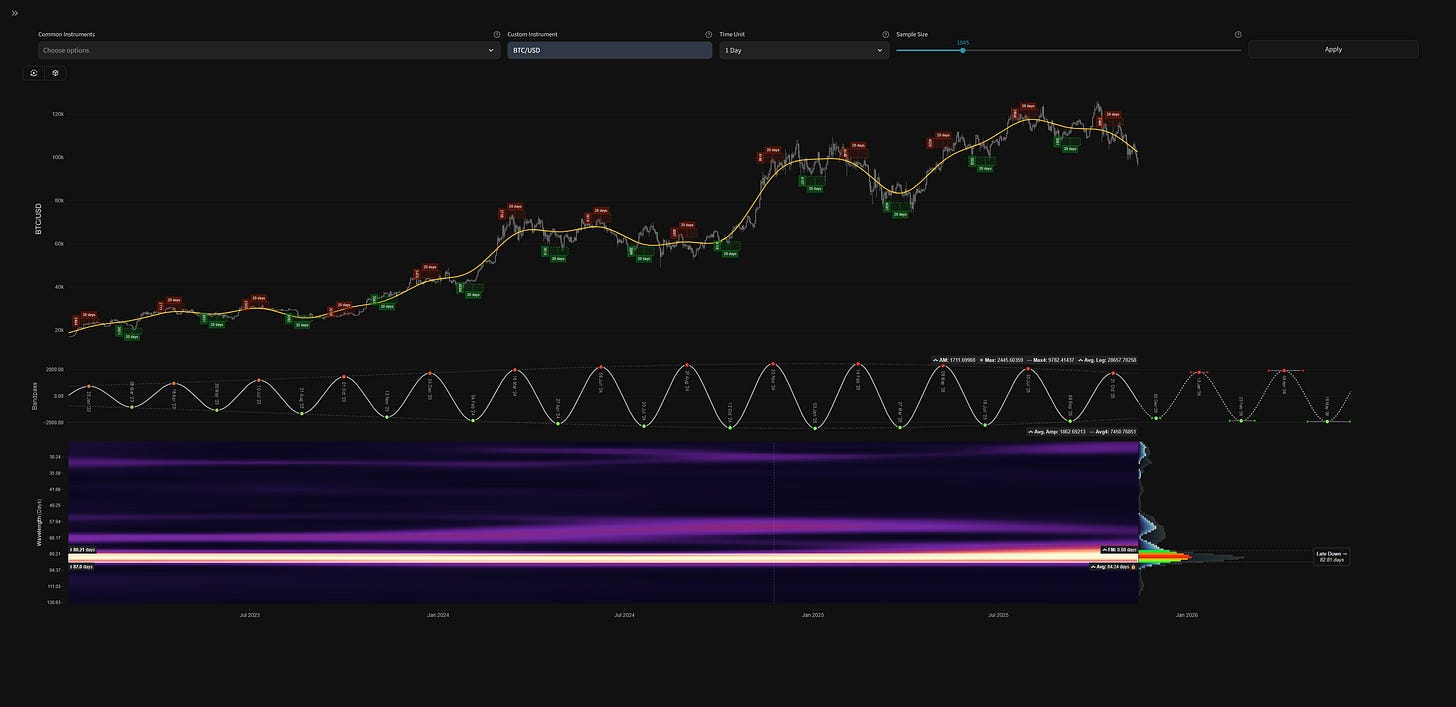

Our bespoke time frequency analysis allows the investor or trader to leverage the predictive power of periodic functions present in financial markets. The edge a trader or general investor can gain from a deep knowledge of these techniques will be indispensable.

Analysis Examples

Our Software and Techniques

Our analysis is now given mainly via the microscope of an unbiased time frequency analysis. For more details on this technique please check out our article: Hacking the Uncertainty Principle: Time Frequency

DISCLAIMER: This website/newsletter and the charts/projections contained within it are intended for educational purposes only. Results and projections are hypothetical. We accept no liability for any losses incurred as a result of assertions made due to the information contained within Sigma-L. This report is not intended to instruct investment or purchase of any financial instrument, derivative or asset connected to the information conveyed in the report. Trade and invest at your own risk.