Top 10 Wow! Cycles In Financial Markets: September 2025

Our scanner has been busy uncovering stationary cycle gems in stocks, cryptocurrency, indices and more over the last year or so. Here we select 10 of the very best Wow! signals on offer at the moment.

For more on how we detect periodic features in financial markets please see Hacking the Uncertainty Principle: Time Frequency. You may also wish to read our guide on how to interpret charts on Sigma-L, below is the first part:

With that pre-amble out of the way, below are 10 of the most coherent, daily resolution signals in financial markets at the moment, presented in no particular order!

There are many more very good signals and it was a hard task to distill into just 10. I have tried to include instruments across a wide range of sectors to reflect the remarkable ubiquity of coherent cycles in all markets. All of these were detected by our cycle scanner in the first instance, which is available for intraday trading (live stream) and individual posted analysis in our discord. Membership of which can be obtained by contacting me on X (@tradinghurst) via DM.

The charts below all display a full time frequency analysis showing the detected dominant cycle within the bandwidth of the spectrogram.

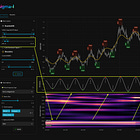

1. Johnson & Johnson (JNJ) | ~ 200 Day Cycle

Component Average Wavelength: ~ 215 days

Current Phase: Hard Up / Late Up

Timeframe: January 2019 - Now

Completed Iterations: 12

Next Cycle Peak: ~ 2nd November - 14th November 2025

Next Cycle Trough: ~ 17th February - 3rd March 2026

Component Yield Over Timeframe: 139.63%

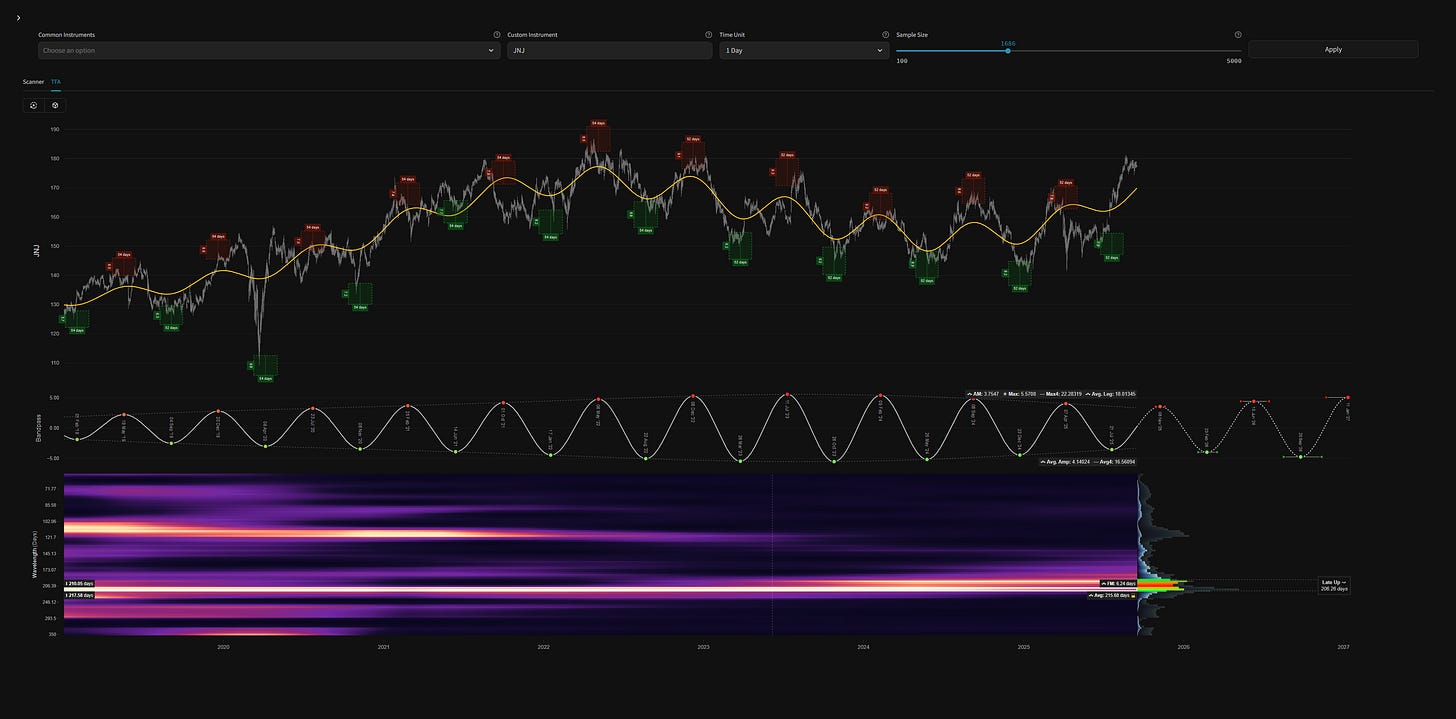

2. Bitcoin (BTC/USD) | ~ 30 Day Cycle

Component Average Wavelength: ~ 30 days

Current Phase: Peaking / Peaked

Timeframe: June 2024 - Now

Completed Iterations: 15

Next Cycle Peak: ~ 16th - 18th October, 2025

Next Cycle Trough: ~ 2nd - 4th October, 2025

Component Yield Over Timeframe: 186.16%

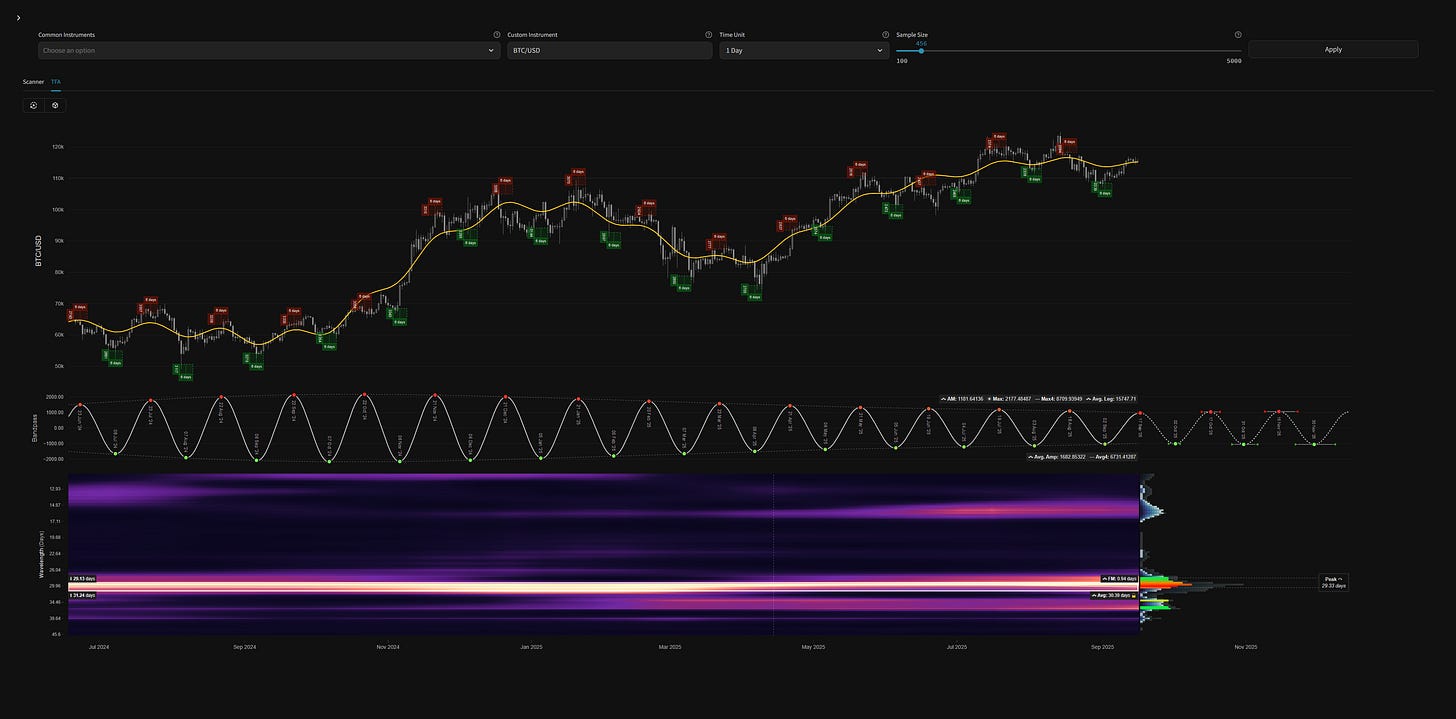

3. US Stock Markets (via SPY/QQQ/IWM) | ~ 258 Day Cycle

Component Average Wavelength: ~ 258 days

Current Phase: Peaking / Peaked

Timeframe: August 2015 - Now

Completed Iterations: 14

Next Cycle Peak: ~ 1st - 21st May, 2026

Next Cycle Trough: ~ 21st December 2025 - 11th January, 2026

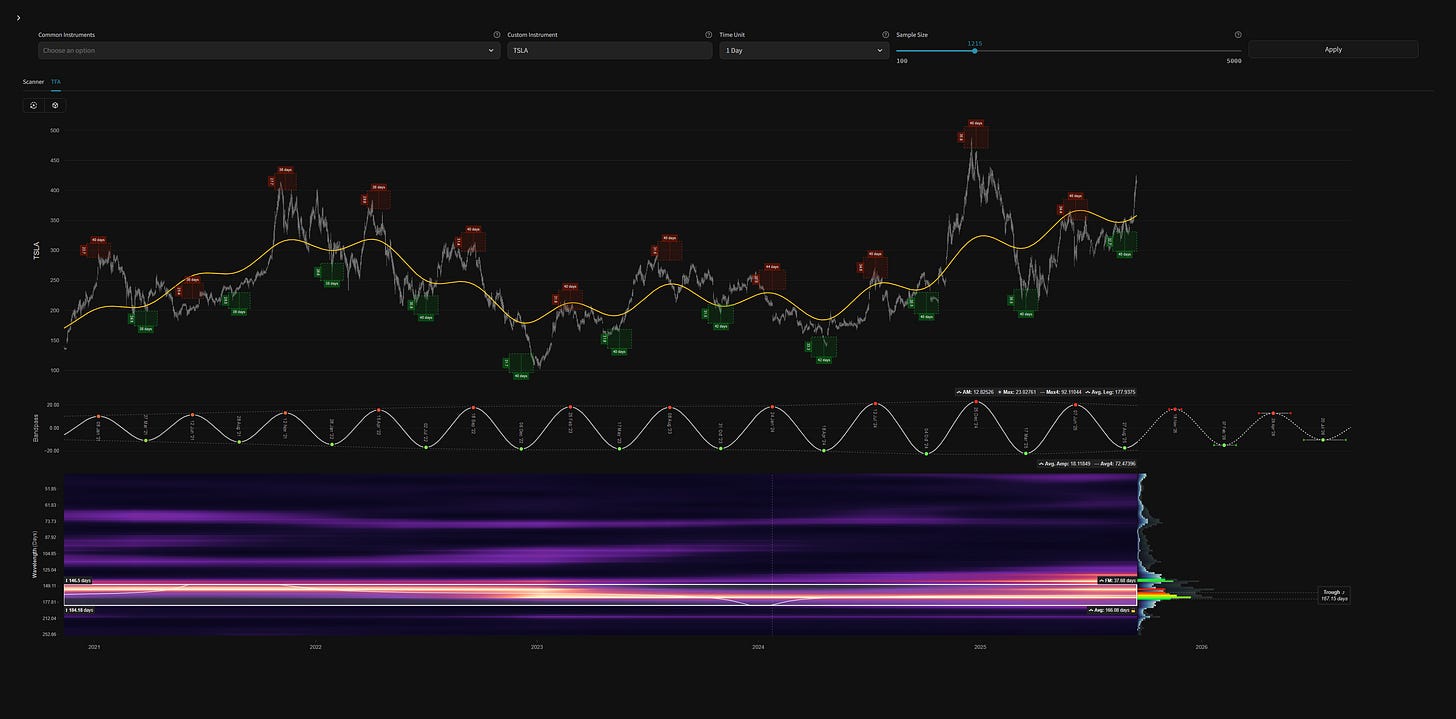

4. Tesla (TSLA) | ~ 166 Day Cycle

Component Average Wavelength: ~ 166 days

Current Phase: Trough / Hard Up

Timeframe: November 2020 - Now

Completed Iterations: 11

Next Cycle Peak: ~ 3rd November - 2nd December 2025

Next Cycle Trough: ~ 23rd January - 23rd February 2026

Component Yield Over Timeframe: 612.41%

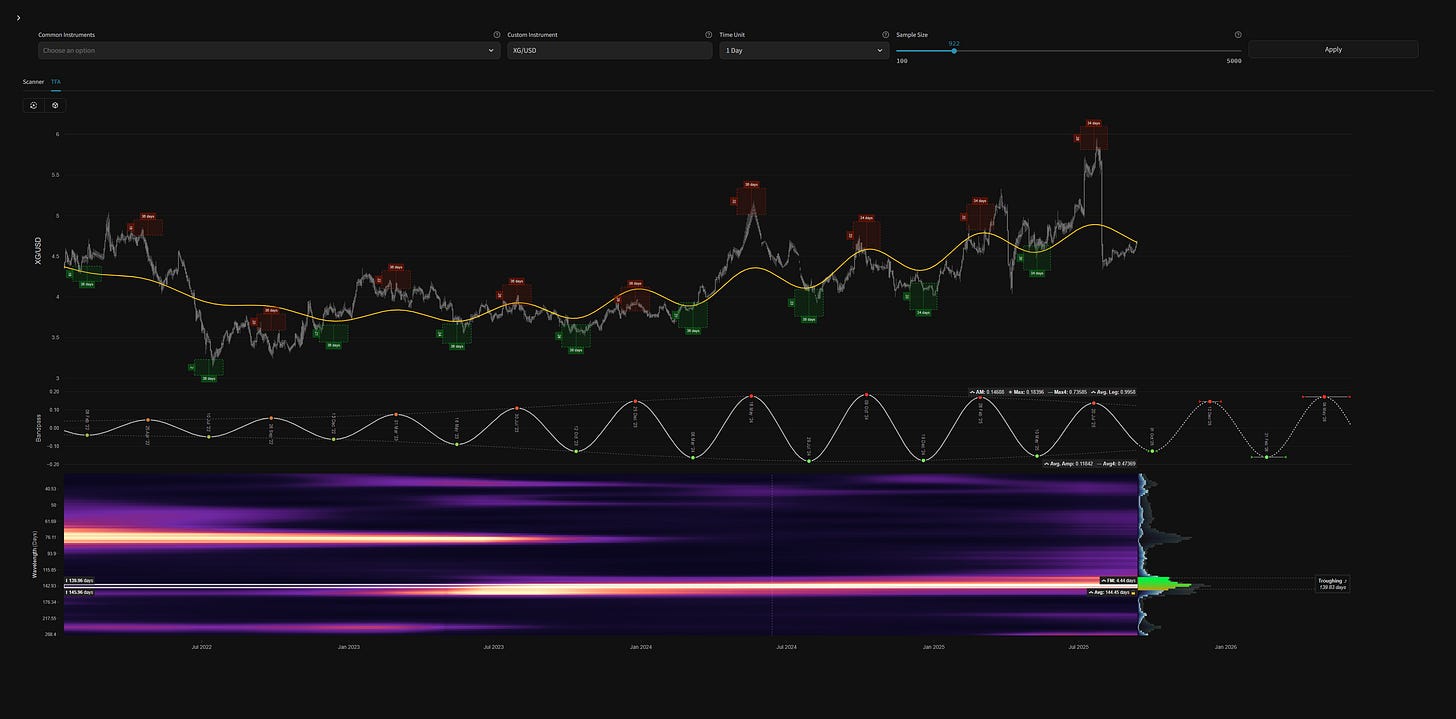

5. Copper (XG/USD) | ~ 144 Day Cycle

Component Average Wavelength: ~ 144 days

Current Phase: Troughing

Timeframe: January 2022 - Now

Completed Iterations: 10

Next Cycle Peak: ~ 8th - 16th December 2025

Next Cycle Trough: ~ 27rd September - 5th October 2025

Component Yield Over Timeframe: 150.86%

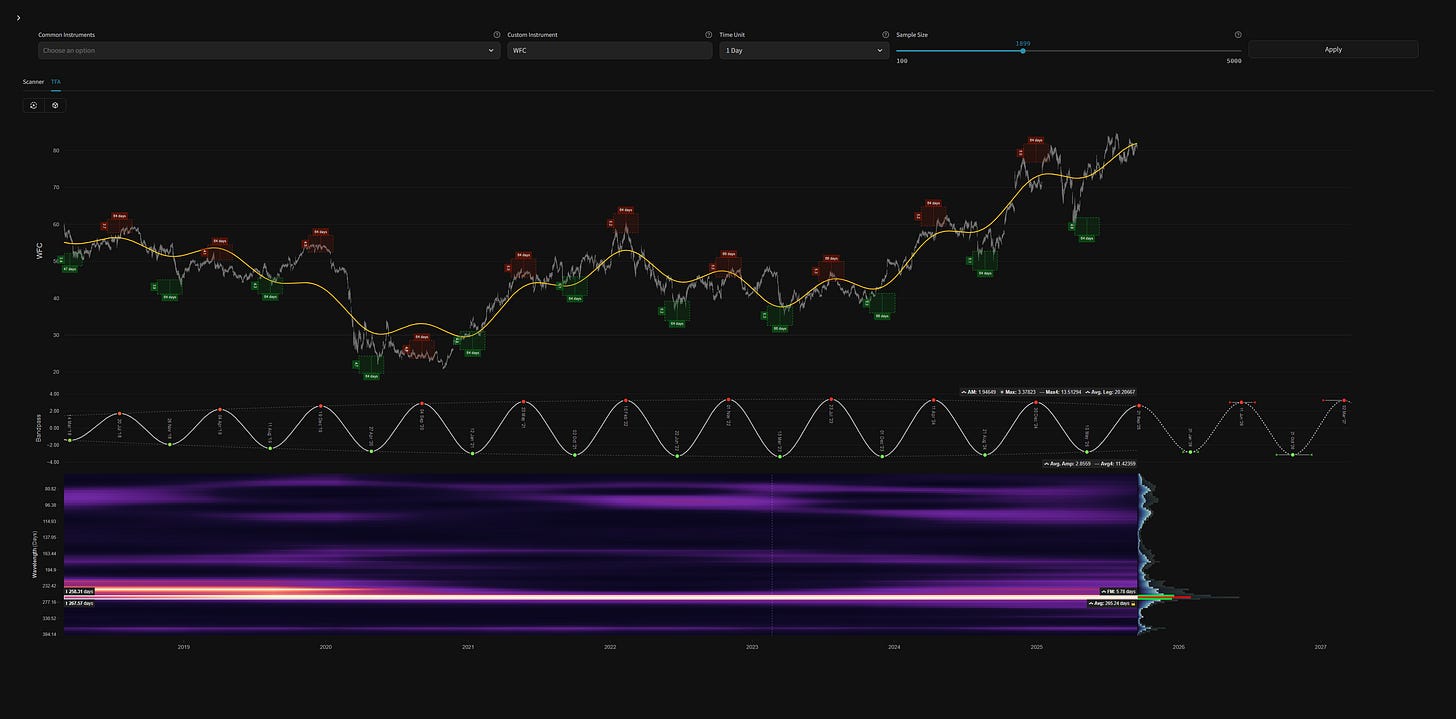

6. Wells Fargo (WFC) | ~ 265 Day Cycle

Component Average Wavelength: ~ 265 days

Current Phase: Peaking / Peaked

Timeframe: March 2018 - Now

Completed Iterations: 11

Next Cycle Peak: ~ 6th - 16th June, 2026

Next Cycle Trough: ~ 26th January - 5th February, 2026

Component Yield Over Timeframe: 248.61%

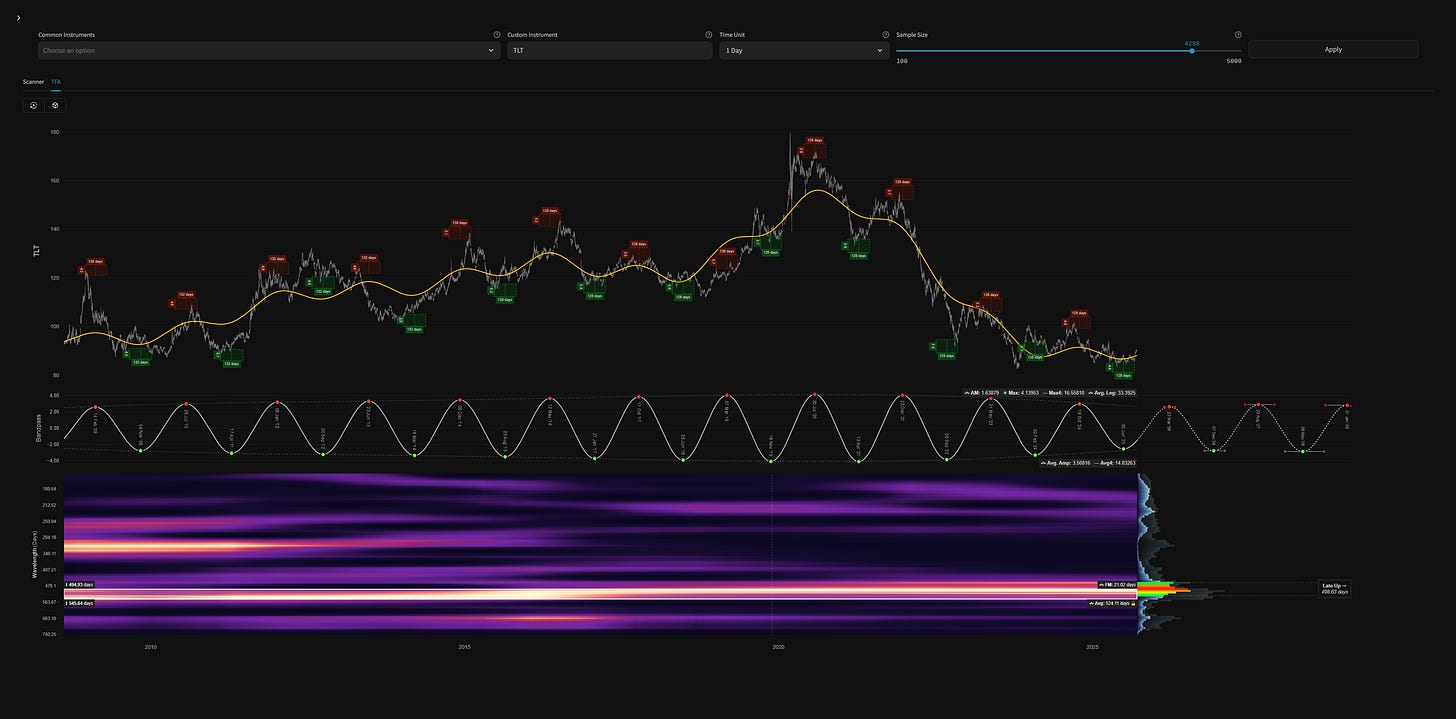

7. iShares 20 Year Treasury Bond ETF (TLT) | ~ 524 Day Cycle

Component Average Wavelength: ~ 524 days

Current Phase: Hard Up

Timeframe: August 2008 - Now

Completed Iterations: 12

Next Cycle Peak: ~ 2nd March - 12th April, 2026

Next Cycle Trough: ~ 24th November - 28th December, 2026

Component Yield Over Timeframe: 188.20%

8. Litecoin (LTC/USD) | ~ 85 Day Cycle

Component Average Wavelength: ~ 85 days

Current Phase: Troughing / Troughed

Timeframe: March 2023 - Now

Completed Iterations: 12

Next Cycle Peak: ~ 1st - 3rd November, 2025

Next Cycle Trough: ~ 13th - 15th December, 2025

Component Yield Over Timeframe: 321.25%

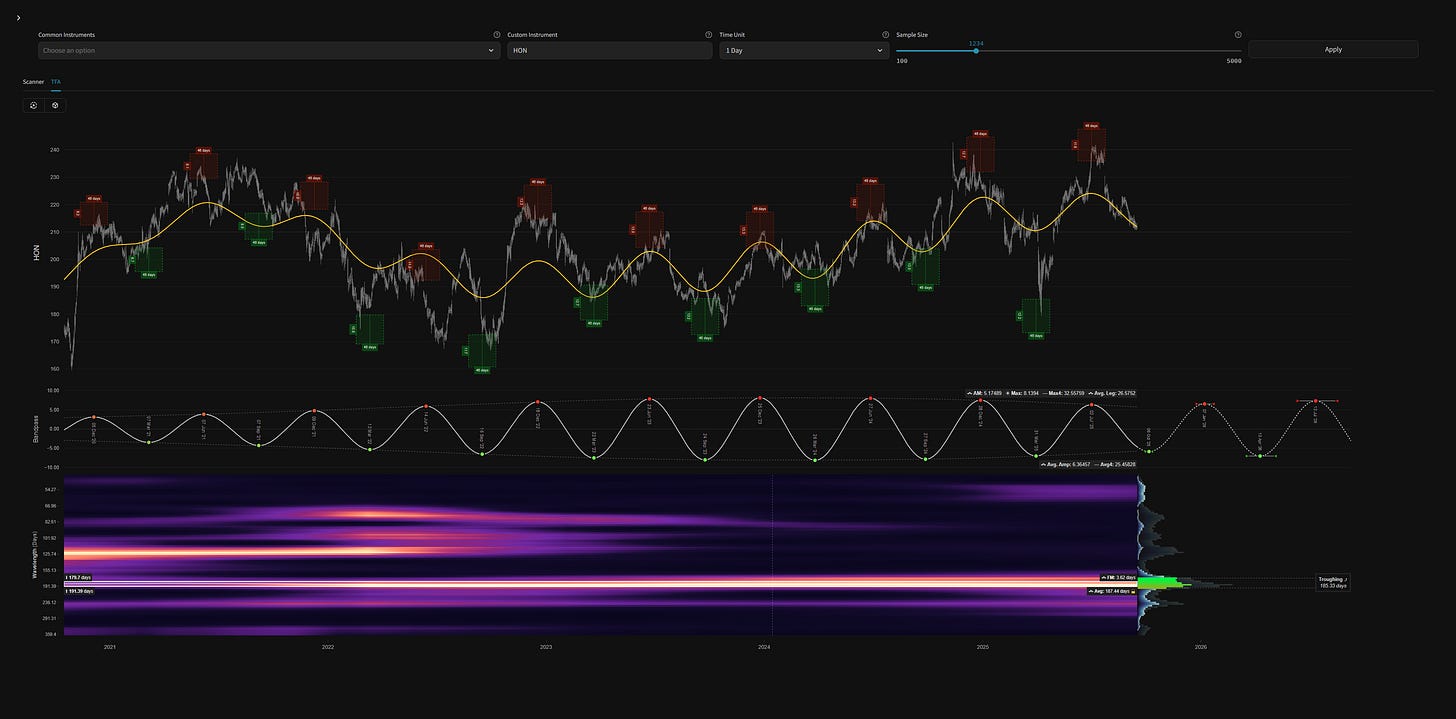

9. Honeywell (HON) | ~ 187 Day Cycle

Component Average Wavelength: ~ 187 days

Current Phase: Troughing / Troughed

Timeframe: October 2020 - Now

Completed Iterations: 9

Next Cycle Peak: ~ 3rd - 11th January, 2026

Next Cycle Trough: ~ 2nd - 12th October, 2025

Component Yield Over Timeframe: 133.20%

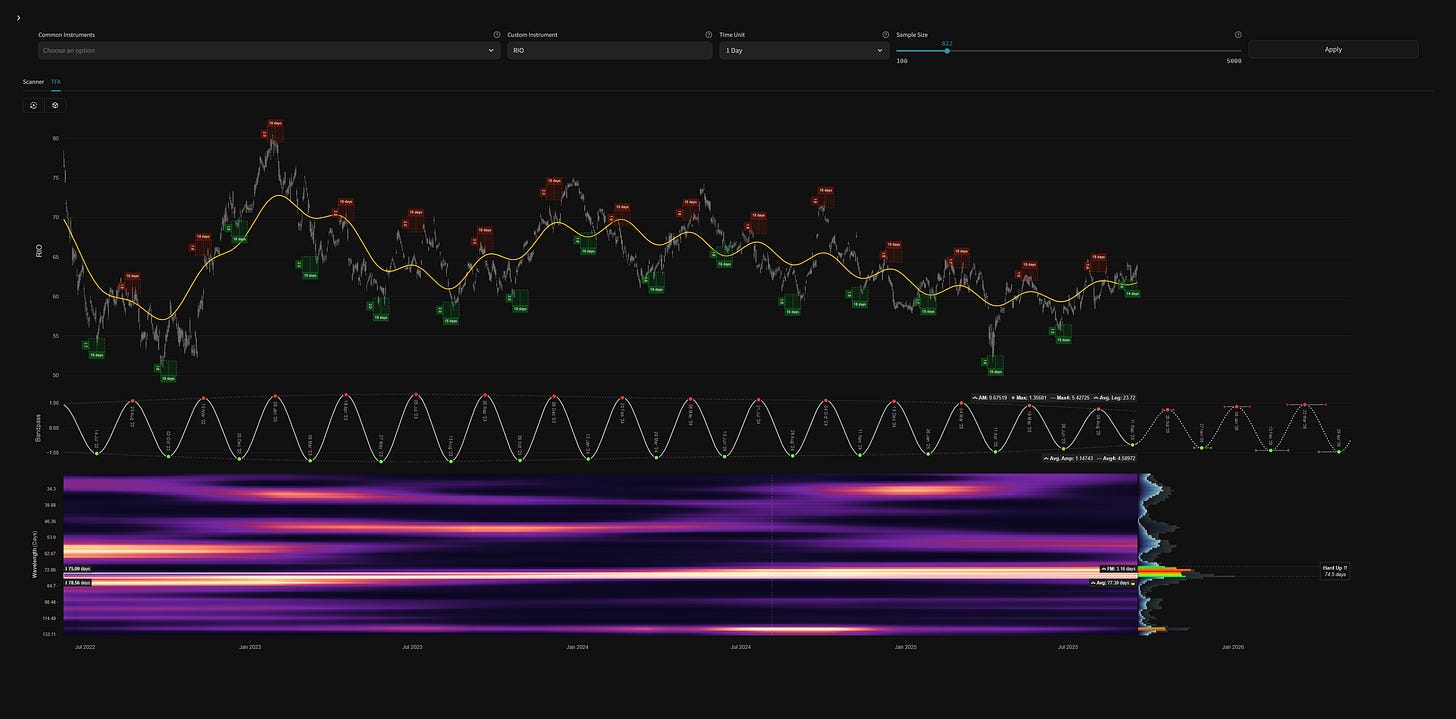

10. Rio Tinto (RIO) | ~ 77 Day Cycle

Component Average Wavelength: ~ 77 days

Current Phase: Troughing / Troughed

Timeframe: June 2022 - Now

Completed Iterations: 16

Next Cycle Peak: ~ 17th - 23rd October, 2025

Next Cycle Trough: ~ 24th - 30th November, 2025

Component Yield Over Timeframe: 130.21%

How you calculate cycle for each stock ?

Awesome! how is calculated the Component Yield Over Timeframe?

Thanks