GBPUSD: Hurst Cycles - 14th November 2022

Sterling moves up from a low of at least 40 week magnitude in late September. The first 80 day nominal peak of this larger component is now due, we look at the current position and outlook for price

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Phasing Analysis

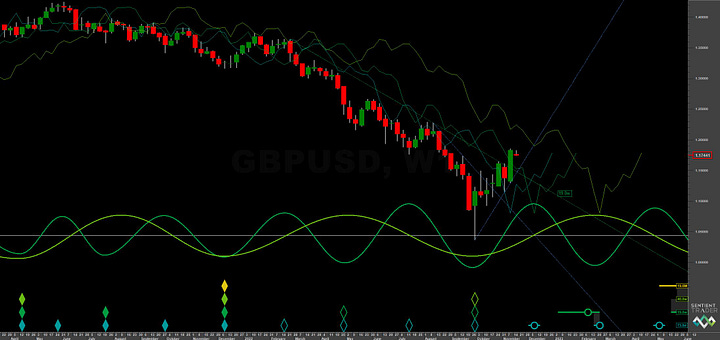

Sentient Trader

Utilising a pattern recognition algorithm and Hurst’s diamond notation.

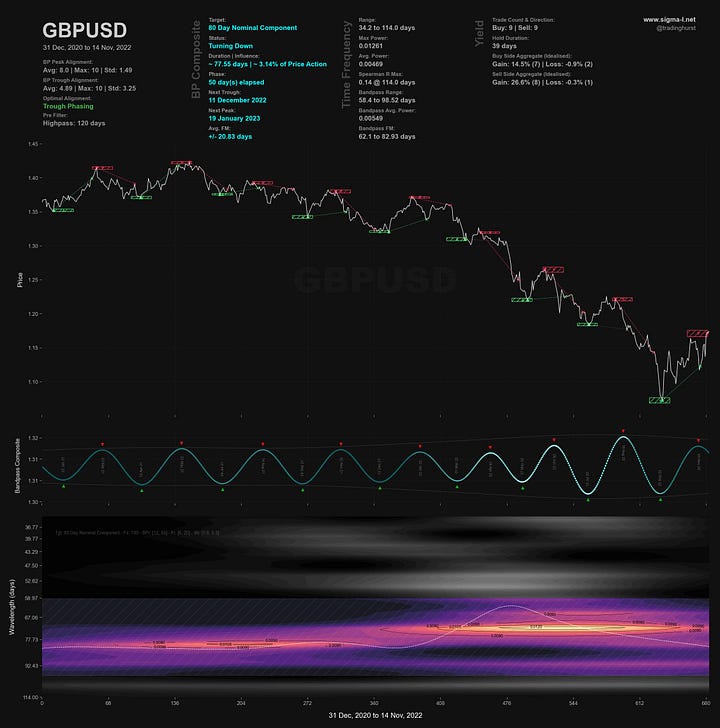

Time Frequency Analysis

Wavelet convolution targeting the 80 day nominal component

Analysis Summary

Price moved up in a predictable fashion from what is highly likely to be at least a 40 week nominal low in late September. The 40 day component low subsequently occurred on the 4th November, price moving up once again to approach the 40 week FLD and our target of around 1.20 from the previous report.

The long term picture remains largely unchanged and we retain the most recent 18 month nominal low phasing in December 2021. Should price surge above the 40 week FLD resistance in coming months (described more below) we will revisit the longer components. This is an outlier scenario.

At the medium to short term we have FLD cross targets yet to be met for the 80 day component (1.21, days left to hit) and 20 week component (1.28, a month or so to hit). The first signs of continued underlying bearishness will be firstly a failure to reach the 1.21 target in this current 80 day component (which is peaking imminently) and more notably, a continual tracking/resistance at the 40 week FLD over the coming months. A tracking of this nature will also mean the 20 week target at 1.28 will be heavily undershot. Indeed, should price track the 40 week FLD all the way down to the lows at 1.03 by the end of February 2023, it would be a very bearish sign for sterling in the current 18 month component phasing.

Short term price waves are giving clarity, the 80 day component running around 77 days from both Sentient Trader and time frequency analysis is good. The 40 day component (38 days) is also showing good amplitude and this has allowed a VTL to be drawn (dark blue) across the lows. A cross of which confirms an 80 day nominal peak has occurred in the recent past.

The next 80 day nominal low is expected early - mid December and will likely find support around the 80 day FLD at 1.13-1.14.

Trading Strategy

Interaction Status

Interactions and price in the FLD Trading Strategy (Advanced). This looks at an idealised 40 week cycle and an array of 3 FLD signal cycles. We apply the instrument’s phasing to the model and arrive at an overall summary for the interactions with the 20 day FLD, current and forthcoming.

Sigma-L recommendation: Risk Sell / Neutral

Entry: 10 Day FLD (risk on) / 20 Day FLD

Stop: Above formed 80 day nominal peak

Target: 1.13-1.14 (80 day FLD support)

Reference 20 Day FLD Interaction: F

Underlying 40 Day FLD Status: D

Underlying 80 Day FLD Status: B

Given the formation of a low of 40 week magnitude the short on offer here is a risk sell with an expectation of support around the 80 day FLD circa 1.13-1.14 mid December. Price is currently 49 days along the phase of the 80 day component at 73-78 days average wavelength.

Traders holding long from the last report may wish to close out trades or retain a small portion for a possible late surge in the next few days to the 40 week FLD resistance around 1.19 - 1.20, shown in light green on the short term Sentient Trader chart.

FLD Settings

If you do not have the use of Sentient Trader use these settings to plot common FLDs in your trading software (daily scale) to more easily follow trading signals and strategy from Sigma-L.

Make sure to account for non-trading days if your broker omits them in the data feed (weekends, for example). The below offsets are given with no added calculation for non-trading days.

80 day nominal: 73 days | 37 day FLD offset

40 day nominal: 38 days | 19 day FLD offset

20 day nominal: 19 days | 10 day FLD offset

10 day nominal: 9.5 days | 5 day FLD offset

Too tight for my trading style David, but an excellent analysis from which I've gleaned a heap of info.