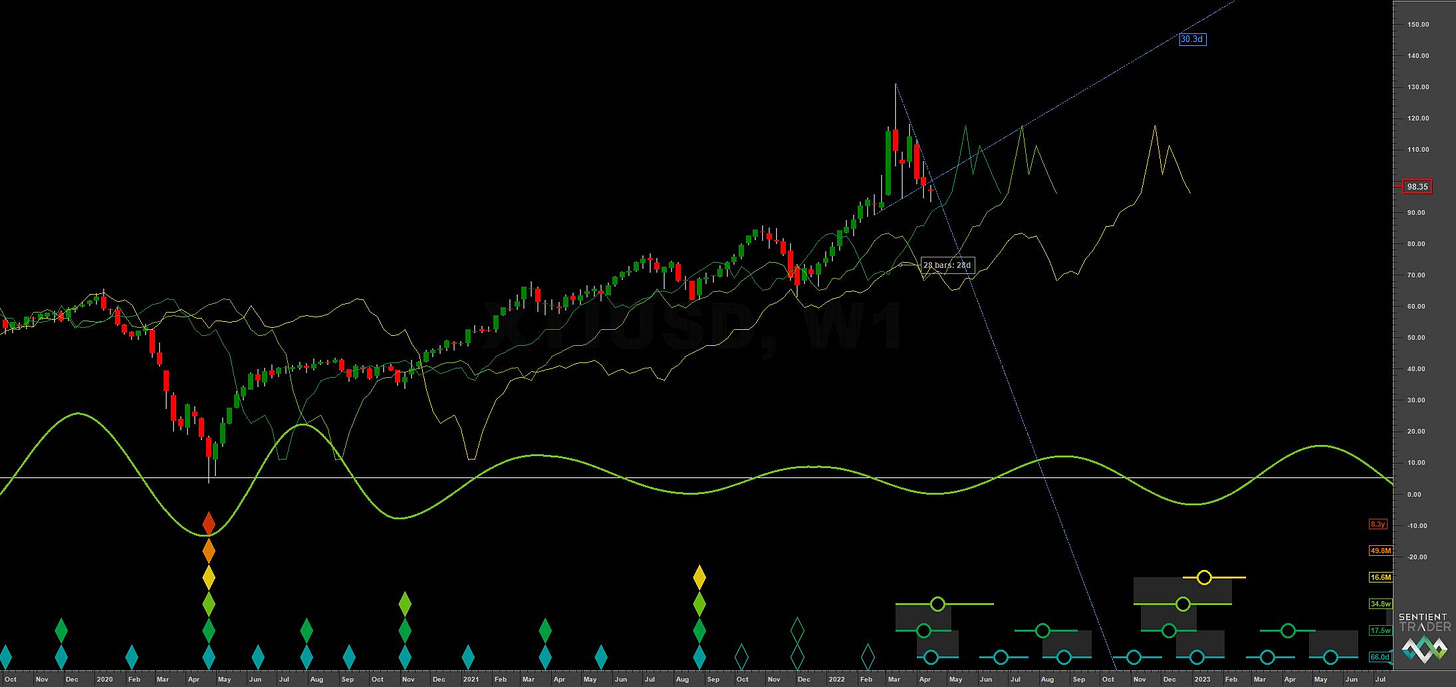

Oil: Hurst Cycles - 12th April 2022

We report on the excellent short trade from 24th March and analyse what is expected to be at least a 20 week nominal low coming soon

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Phasing Analysis

Long Term

Components greater than and including the 18 month nominal cycle

Medium Term

Components less than and including the 18 month nominal cycle

Short Term

Components around the 80 day nominal cycle

Analysis Summary

The move from the 40 day nominal peak into what is likely a trough of at least 20 week magnitude, described in the last report on crude oil, was a classic trade. Price tracked the 40 day FLD very nicely, setting up entries via either the 5, 10 or 20 day FLDs for yields of 10-16%.