ΣL US Stock Market Composite - 23rd July 2025 | @ 36 Weeks | + 18.84%

Last trade: + 18.84% | 'C' class signal detected in ΣL US Stock Market Composite (SPY, QQQ, IWM, DIA). Average wavelength of 36 weeks over 16 iterations since November 2014. Currently peaking.

ΣL Cycle Summary

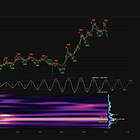

It is that time again where we return to one of our favourite cycles in US stock markets (and indeed to some extent global stock markets), the 40 week nominal wave - in Hurst nomenclature. Although not the most coherent cycle when considered against all other types of financial market, this wave is still one of the more stationary cycles in stock markets of the last 20 years. Gaining dominance around 2016 (see SPY chart below) this cycle has retained power since then to a decent degree, yielding exceptional results between 2016-2020.

The most recent up leg has been remarkably linear in nature, yielding over 20% in both IWM (Russell 2000) and QQQ (Nasdaq) whilst SPY gained 14.57% over the period. Phase is now hard-up/peaking so we are a touch early here, however, with the larger 3.5 year wave now pushing hard down subscribers should be aware.

Amplitude has increased massively for the last two legs of this cycle, shown in the high pass filtered SPY chart below. Whether it is retained for the upcoming down leg into late this year remains to be seen.

Trade Update

Summary of the most recent trade enacted with this signal and according to the time prediction detailed in the previous report for this instrument, linked below.

Type: Early Buy - ΣL US Stock Market Composite 13th March 2025

Entry: 13th March 2025

Exit: 22nd July 2025

For a composite analysis, each constituent’s respective gain over the period is displayed, in descending order. The average of the constituent gain is also shown.

Constituent Gain:

IWM (20.99%)

QQQ (20.97%)

SPY (14.57%)

Composite Average Gain:

18.84%