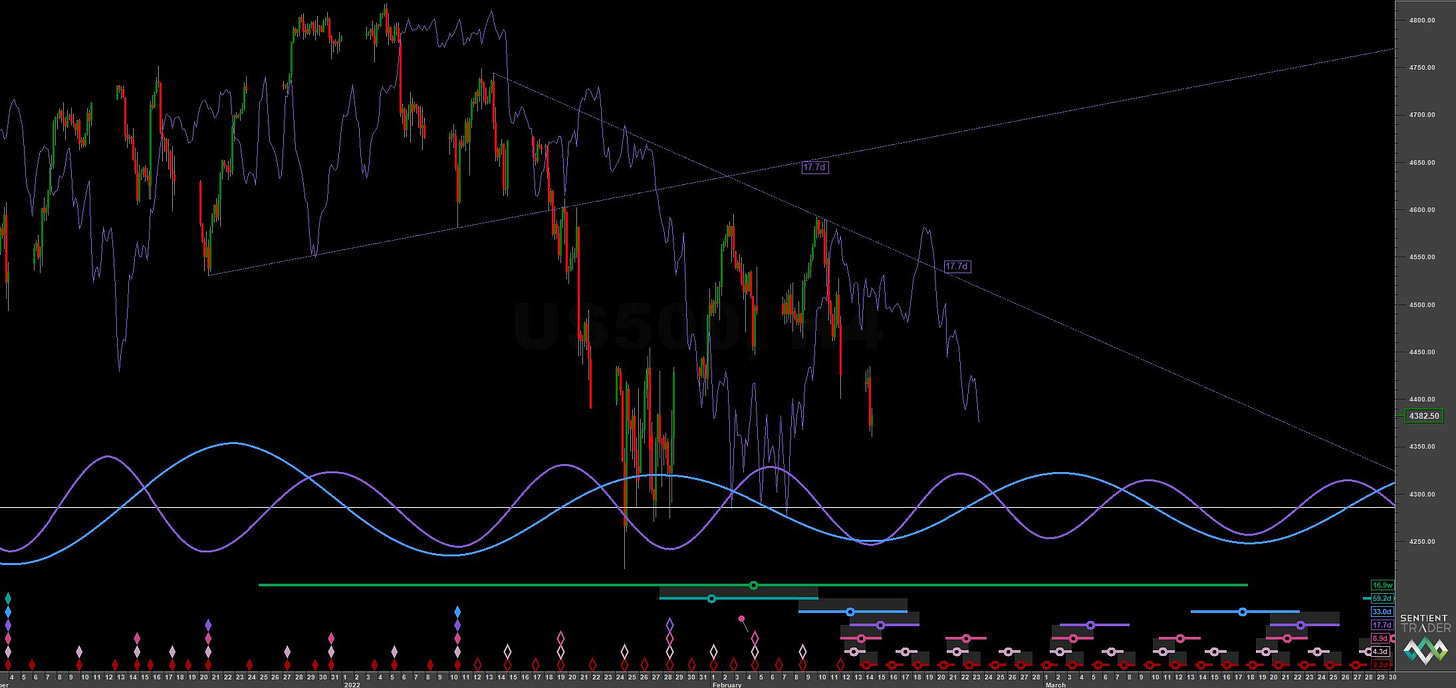

S&P 500: Hurst Cycles - 14th Feb 2022

Standard & Poor's 500 Index | Phasing Analysis Update, Outlook & Trading Strategy

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality

Phasing Analysis

Long Term

Components greater than and including the 18 month nominal cycle

Medium Term

Components less than and including the 18 month nominal cycle

Short Term

Components around the 80 day nominal cycle

Below, the two possible phasings for the S&P, at the daily and 4 hour scale. Both present similar positions of the 20 day FLD.

Summary

In our last report into the S&P 500 and stockmarkets in general we were anticipating the move into the 40 week nominal low due at the start of February 2022:

Target is set at 4550 for the 40 day nominal low but traders may wish to hold for the 40 week low at the start of February. There is potential support around 4350 and the 40 week FLD.

If the 40 week low is indeed coming in early February we should expect the incoming 40 day low due at the start of January to test the level of 4500 again. Traders may then wish to hold for the 40 week low due at the start of February 2022, according to the above phasing.