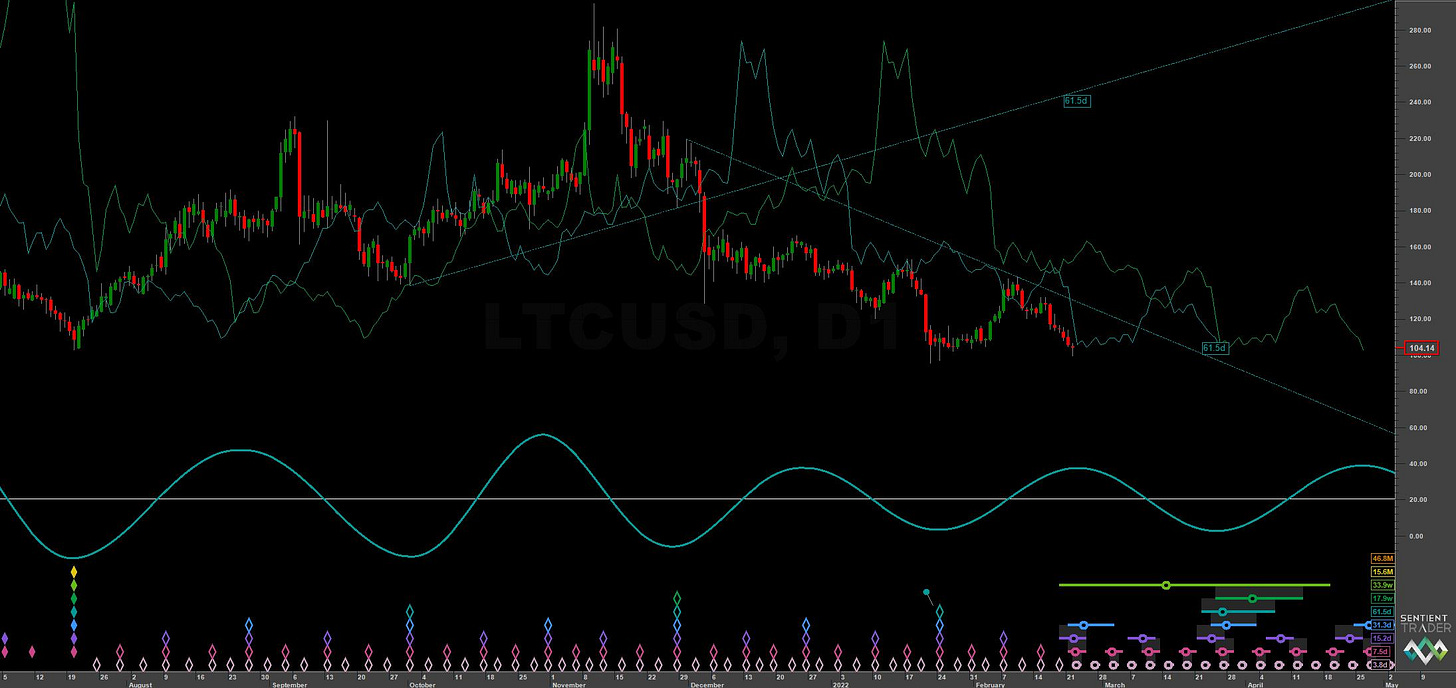

Litecoin: Hurst Cycles - 22nd Jan 2022

LTCUSD | Phasing Analysis Update, Outlook & Trading Strategy

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Phasing Analysis

Long Term

Components greater than and including the 18 month nominal cycle

Medium Term

Components less than and including the 18 month nominal cycle

Short Term

Components around the 80 day nominal cycle

Summary

We left Litecoin in the last report near the 40 day nominal low in early January. Price came up to our target of 140-145 subsequently and was actually the only crypto instrument we cover to reach it’s targets from this low, reflecting the overall bearish underlying trend in cryptocurrency at that point.

Price action has taken a bearish turn after the most recent flat 40 day component. The next 40 day component is expected to be more bearish but there is a small window of opportunity to profit from the 40 day component move up for risk on traders. Strong resistance exists at the 140-145 area from the overlapping 40 day and 80 day FLDs (shown in short term chart, blue) and should therefore be the target. Price is currently at the 5 day FLD (shown on 4 hour chart in white).