The Periodical: 22nd July 2022

Stock Markets and Cryptocurrency make 20 week nominal lows, Dollar Index looks to peak, Gold looks to trough, Oil chops bearishly and EURUSD turns up way before any 'surprise' monetary meddling

Chart Highlight: Dollar Index

Round Up

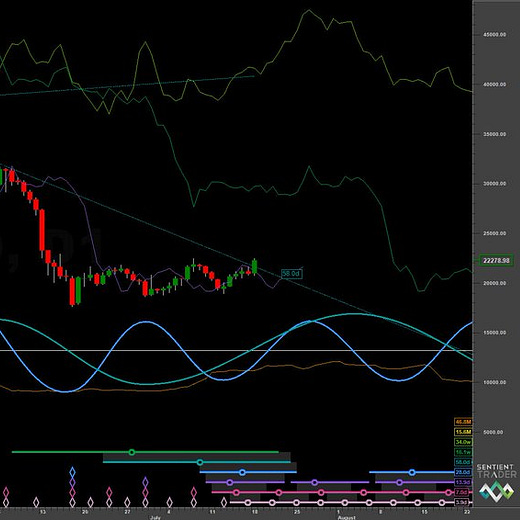

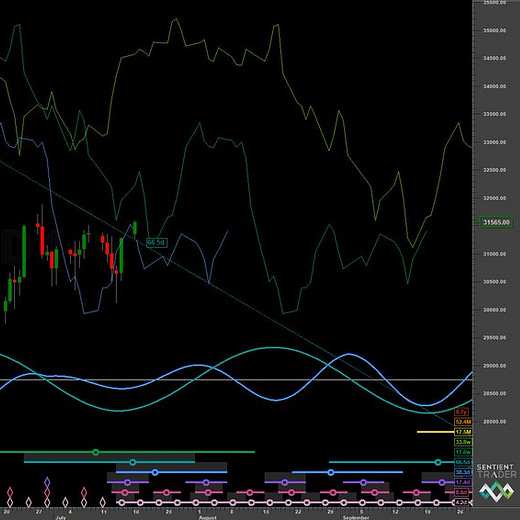

All eyes have been on the stock and cryptocurrency markets as traders speculate whether a large low has occurred. From a cyclical perspective it is highly likely a 40 day nominal low occurred in both markets around the 13th-15th of July and that low is phased longer term as at least a 20 week component trough. In crypto in particular we are not convinced a larger trough (18 month nominal) has occurred at this point, we would like to see some kind of interaction with the 54 month FLD, shown below in Bitcoin, in orange. At that point there should be longer term support and a multi month rally. In both scenarios the next 20 week (running circa 16.1 weeks sample average here) trough in October/November will be a critical juncture. It is likely the majority of the move down in this current 18 month component is complete.

In Forex, the hugely linear move in the Dollar Index from 2021, a 9 year nominal low at least, has crushed other global currencies in it’s wake. That process is now, at least for a short breather period, coming to an end. Both EURUSD and GBPUSD have made 20 week nominal lows at least, the former turning up from the cycle low over a week before the ‘surprise’ rate decision from the ECB.

Oil continues to begin it’s move down to a proposed 20 week nominal low in late August. The 9 year low that occurred in 2020 will still have some bullish momentum to bear in due course but commodity bulls are becalmed. The exuberant bullish sentiment around Oil and other commodities in the early part of 2022 was typical of a larger cycle peak, here most likely the 54 month nominal component.

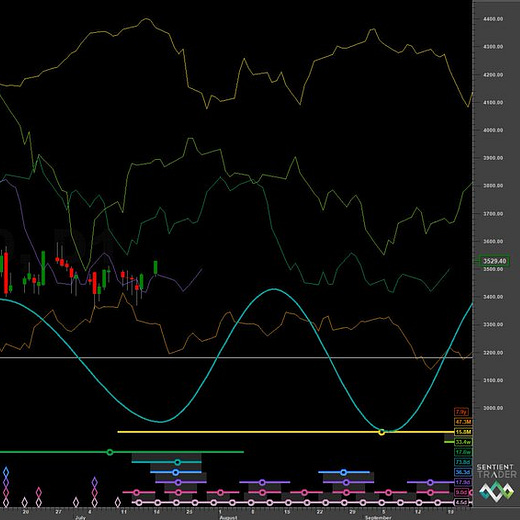

The precious metals are well overdue the 80 day nominal low and it seems, at least on initial price action, to have occurred yesterday. There is some thought from a few Hurstonian analysts that the low is of 18 month magnitude. This is not a view we share at the current time but should this 80 day component form a higher low in late September, we can revisit the longer phasing. We will, of course, bring updates to subscribers at the crucial time points regardless of the longer component phase.

Twitter Highlight

The commonality between stock markets and crypto is compelling, likely driven by money flow. Below, the 40 day nominal component in both looks to make it’s price low.