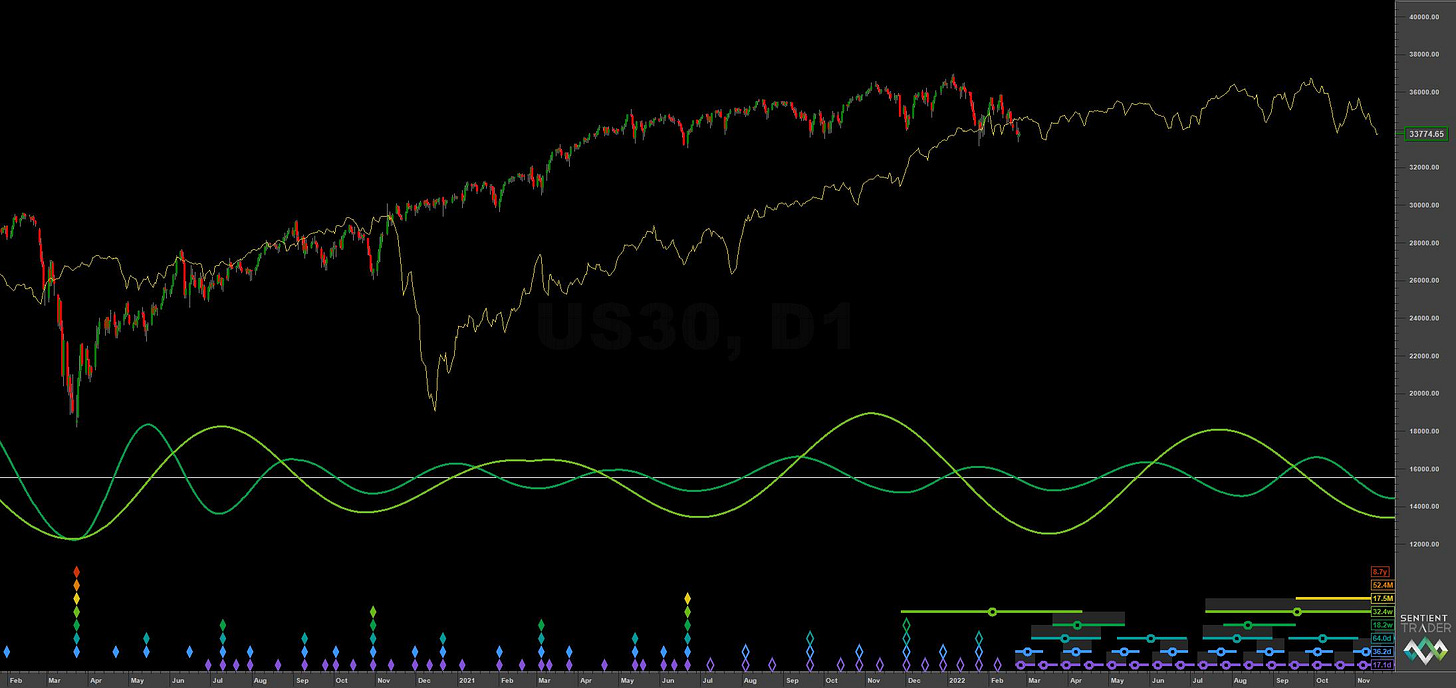

DJIA: Hurst Cycles - 23rd Feb 2022

Dow Jones Industrial Average | Phasing Analysis Update, Outlook & Trading Strategy

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Phasing Analysis

Long Term

Components greater than and including the 18 month nominal cycle

Medium Term

Components less than and including the 18 month nominal cycle

Short Term

Components around the 80 day nominal cycle

Summary

Price action in the DJIA is, of course, very similar to the S&P 500 which we also reported on today. The only difference is relative amplitude modulation. Frequency components are the same (plus some noise component) but our interpretation of their position is affected by the amplitude modulation. So, this report is a good opportunity to look at the alternative phasing which expects a 40 week low at the end of March.