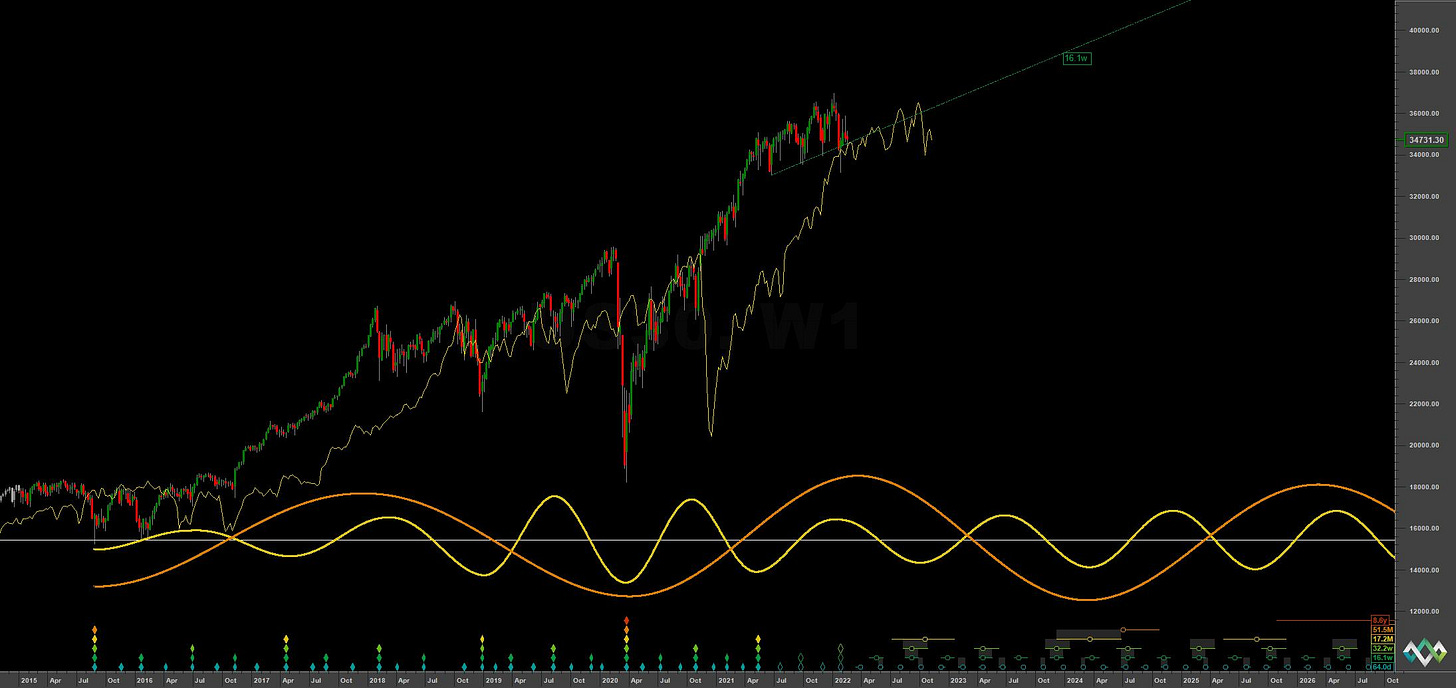

DJIA: Hurst Cycles - 17th Feb 2022

Dow Jones Industrial Average | Phasing Analysis Update, Outlook & Trading Strategy

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality

Phasing Analysis

Long Term

Components greater than and including the 18 month nominal cycle

Medium Term

Components less than and including the 18 month nominal cycle

Short Term

Components around the 80 day nominal cycle

Summary

Moving in commonality with the S&P 500, the DJIA made it’s move toward the 40 week low in early February, as described in the last report:

we can expect the 40 week nominal low in early February and therefore an entry short now may well be a favourable position to hold until then. We might expect the most recent 80 day low around 34000 to be breached if this is the case and confirmation of a 40 week nominal peak will come via a cross of the 20 week VTL, shown in green on the medium term chart.