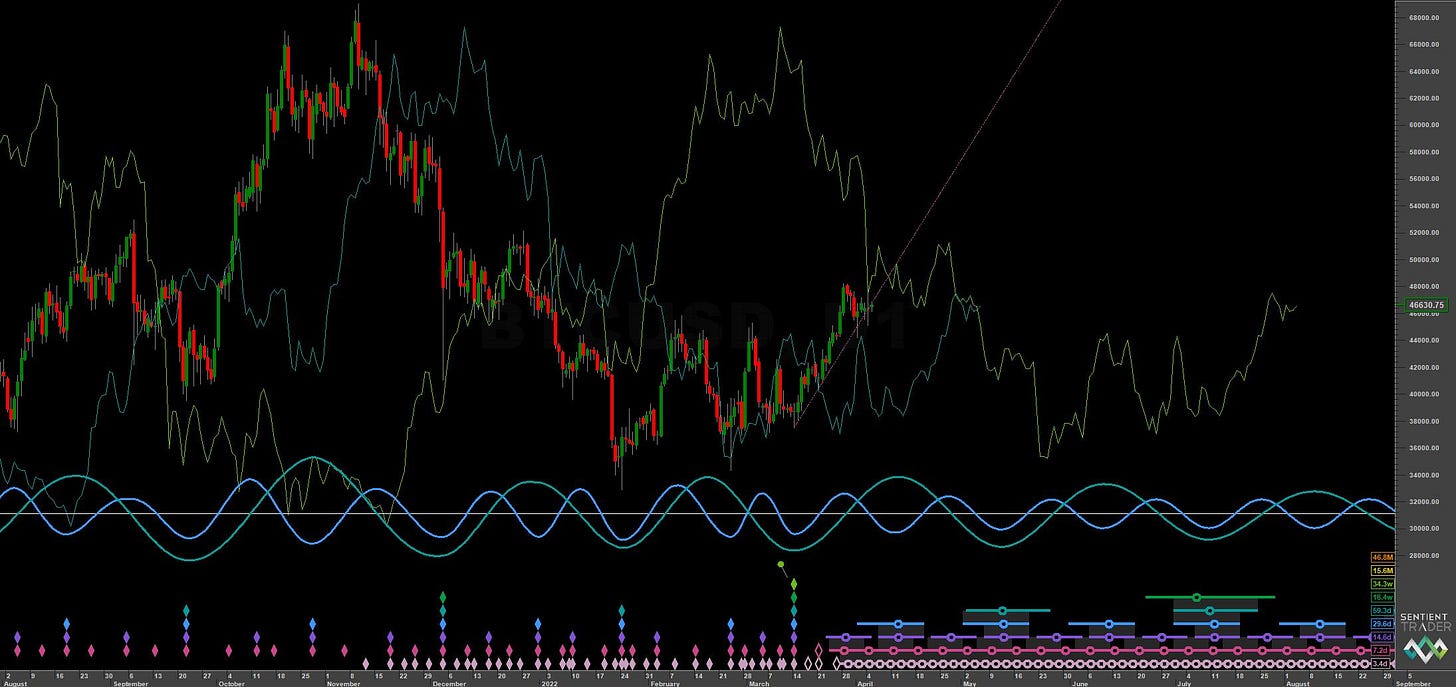

Bitcoin: Hurst Cycles - 5th April 2022

Amplitude modulation obscures the 40 week nominal low, how the principle of commonality helps and the outlook for the next few weeks in the 'king of cryptocurrency'

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Phasing Analysis

Long Term

Components greater than and including the 18 month nominal cycle

Medium Term

Components less than and including the 18 month nominal cycle

Short Term

Components around the 80 day nominal cycle

Analysis Summary

In our last report into Bitcoin on the 2nd of March, we anticipated the incoming 40 week nominal low, clearly due around mid - late March with the 40 week FLD peak exactly above a potential price trough. What we actually got was a tremendous decrease in the amplitude of the 40 day component, resulting in a flat, tepid sideways move to what is now phased as the 40 week low mid March.