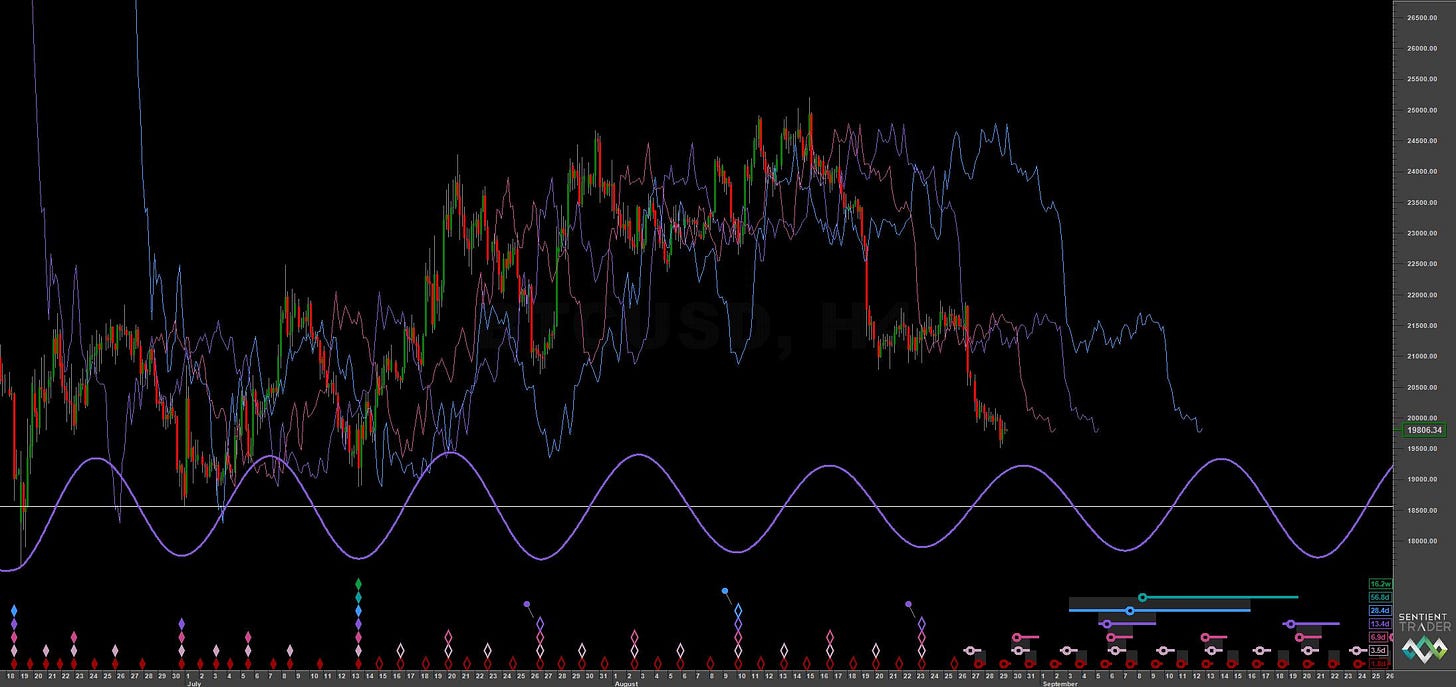

Bitcoin: Hurst Cycles - 29th August 2022

Bitcoin grinds to an upside target of 24000 before meeting resistance at the 20 week FLD. Price now moves into the anticipated 80 day nominal low, due in the next week or so. We look at the next moves

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Analysis Summary

We speculated in our last report on Bitcoin as to the position of the 20 week nominal component low:

From 26th July Report:

If the 20 week nominal low occurred on the 18th of June, the next move should be more bearish, expecting as it does the 80 day nominal low mid August. Should the next move again test 24000 then it is more likely the 20 week low occurred around the 13th July (as we have it phased here) in both cryptocurrency and equity markets.

Price moved up to test our target of 24000 around the 30th of July and subsequently formed a rounding 80 day nominal component peak, as shown in the time-frequency analysis below. This confirmed our view that the 20 week component low (or at least the 80 day component low) most likely occurred around the 13th of July in Bitcoin and the crypto market in general.

The 54 month FLD, a crucial level for cryptocurrency, looms near, below price around the 13-14k mark and shown on the long term phasing analysis from Sentient Trader below.

It is highly likely Bitcoin will find support around that area for the incoming 18 month nominal low and is approaching the tight nest of lows for that component, shown most notably on the long term chart. As mentioned before, it is likely the majority of the downside move in the 18 month component is complete, the overarching question now being whether the next large low is only of 18 month magnitude or, favourably for bulls(!), the 54 month component low. Expect increased volatility as we enter into this next period and take note of increased bearish sentiment in the media (and social media) as a sign of an incoming large magnitude trough.

The 20 week component at the medium term outlook is still very much compelling. Currently an extrapolation of the component places the 18 month low in late October, with one more 80 day component to come. However, as soon as price enters into the nest of lows for the 18 month nominal low traders should be on alert for the larger trough. An 80 day component margin of error in the 18 month wave is common and is reflected in the frequency modulation of the larger wave.

Placing the previous 18 month component low in July 2021 gives an elapsed time of 13 months at the current point. Placing the 18 month component low in May 2021 gives an elapsed time of around 15.4 months. The average wavelength of the 18 month component from the overall sample is 15.6 months. This demonstrates the 80 day component margin of error in the phasing, as expected. In both scenarios, the larger low is close. We will continue to monitor the phasing for timing and, of course, update subscribers when necessary.

Phasing Analysis

Long Term

Components greater than and including the 18 month nominal cycle

Medium Term

Components less than and including the 18 month nominal cycle

Short Term

Components around the 80 day nominal cycle

Time Frequency

Wavelet convolution output targeting 80 day and 40 day nominal components

Trading Strategy

Interaction Status

Interactions and price in the FLD Trading Strategy (Advanced). This looks at an idealised 40 week cycle and an array of 3 FLD signal cycles. We apply the instrument’s phasing to the model and arrive at an overall summary for the interactions with the 20 day FLD, current and forthcoming.

Sigma-L recommendation: Risk Buy

Entry: 10 Day FLD

Stop: Below formed 80 day nominal low

Target: ~ 24000

Reference 20 Day FLD Interaction: A4

Underlying 40 Day FLD Status: E2

Underlying 80 Day FLD Status: G

A retest of the 24000 area and the 80 day FLD is the most logical conclusion to draw from the current phasing, although at the time of writing this report we are fairly early for the 80 day nominal low. The longer term picture is still resolving and the 54 month FLD looms below price as mentioned in the summary. Watch closely the reaction of price if and when the 80 day FLD is tested (light blue, short term chart) for signs that the 18 month nominal low is still to come in October. Also watch price if it reaches the 40 week downward VTL (green, medium and long term charts). A cross of which by median price on a weekly basis confirms the 18 month nominal low has likely occurred in the recent past.

Longer term bulls may well choose to get some exposure at these levels as the majority of the downside move in the 18 month component has likely been completed, in our view.

FLD Settings

If you do not have the use of Sentient Trader use these settings to plot FLDs in your trading software (daily scale) to more easily follow trading signals and strategy from Sigma-L.

Make sure to account for non-trading days if your broker omits them in the data feed (weekends, for example). The below offsets are given with no added calculation for non-trading days.

80 day nominal: 55.3 days | 28 day FLD offset

40 day nominal: 27.7 days | 15 day FLD offset

20 day nominal: 15.7 days | 8 day FLD offset

10 day nominal: 7.8 days | 4 day FLD offset

Correlated Exposure Options

A non exhaustive list of correlated instruments for consideration

ProShares Bitcoin Strategy ETF BITO 1.03%↑

Valkyrie Bitcoin Strategy ETF BTF -0.47%↓

VanEck Bitcoin Strategy ETF XBTF 0.00

Global X Blockchain & Bitcoin Strategy ETF BITS 0.00

Global X Blockchain ETF BKCH -2.23%↓

Siren Nasdaq NexGen Economy ETF BLCN -0.37%↓

Bitwise Crypto Industry Innovators ETF BITF 3.05%↑

First Trust SkyBridge Crypto Industry and Digital Economy ETF CRPT 0.00