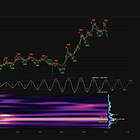

Bitcoin (BTCUSD) - 27th June 2025 | @ 31 Day Cycle | + 0.77%

Last trade: + 0.7% | 'B' class cycle detected in Bitcoin. Running at an average wavelength of 31 days over 15 iterations since March 2024. Currently peaking

ΣL Cycle Summary

Since our last report on this excellent short term cycle from June 13th, price has printed a fairly sideways up leg. We know that the larger wave, around 85 days, is now pushing up, suggesting that if the next down leg of this smaller and less powerful component is also generally sideways, bullish moves await at the start of July.

In general financial markets show a ~ 1/f distribution of power in the frequency domain (power decreases with increasing frequency) so the larger wave should be given more weight and will influence price action more. The exception to this is when the larger wave is at an inflection point and the power (correlation to price) is negligible, smaller cycles can then dominate. In price action this would be seen as a sideways move for the larger wave and within it a smaller component is dominant. See below charts for a couple of examples where the underlying trend is flat and the ~ 30 day wave comes to the fore.

Trade Update

Summary of the most recent trade enacted with this signal and according to the time prediction detailed in the previous report for this instrument, linked below.

Type: Late Buy - Bitcoin 13th June 2025

Entry: 13th June 2025 @ 106118.70

Exit: 27th June 2025 @ 106930.66

Gain: 0.77%