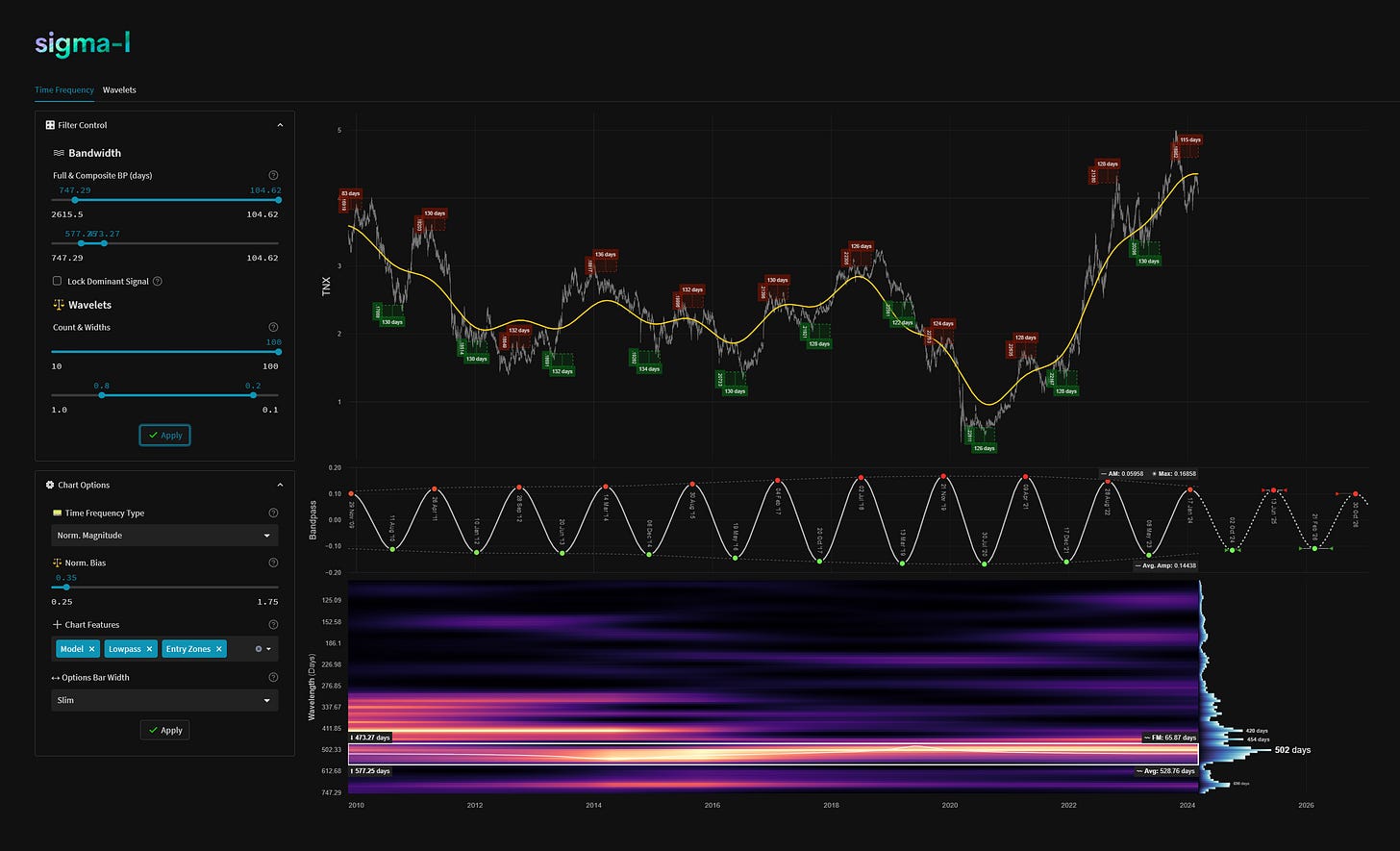

US 10 Year Treasury Yield - 8th March 2024 | @ 529 Days | + 16.42%

Last Trade: + 16.42% | 'B' class signal detected in US 10 Year Treasury Yield. Running at an average wavelength of 529 days over 10 completed sample iterations since Nov. 2009. Currently turning down

ΣL Cycle Summary

The excellent longer term cyclic component in the US 10 Year Treasury Yield moved up over the last year or so in a fairly sharp manner. This comes after the most recent trough of the wave, around April 2023, was established in line with expectations for the phase of this component. Price subsequently made new highs over the 2022 price peaks. The component is now in the process of peaking with a smaller wave forming a pullback to the initial price highs of the longer wave in the last few months. It seems likely that the price peak in January of this year will be the highest price within the cycle (a slightly ‘left translated’ price peak). Hurst aficionados will note the wavelength of this component as 17.38 months, or the 18 month nominal wave. We speculate the next trough of this wave should come around the start of the last quarter 2024, more detail below.

Trade Update

Summary of the most recent trade enacted with this signal and according to the time prediction detailed in the previous report for this instrument, linked below.

Type: Early Buy - US 10 Year Treasury Yield 24th April 2023

Entry: 24th April 2023 @ 3.515

Exit: 8th March 2024 @ 4.092

Gain: 16.42%

Before and After

Signal comparison between our last report and the current time, in chart format.

Time Frequency Analysis

Time frequency charts (learn more) below will typically show the cycle of interest against price, the bandpass output alone and the bandwidth of the component in the time frequency heatmap, framed in white. If a second chart is displayed it will usually show high-passed price with the extracted signal overlaid for visual clarity.