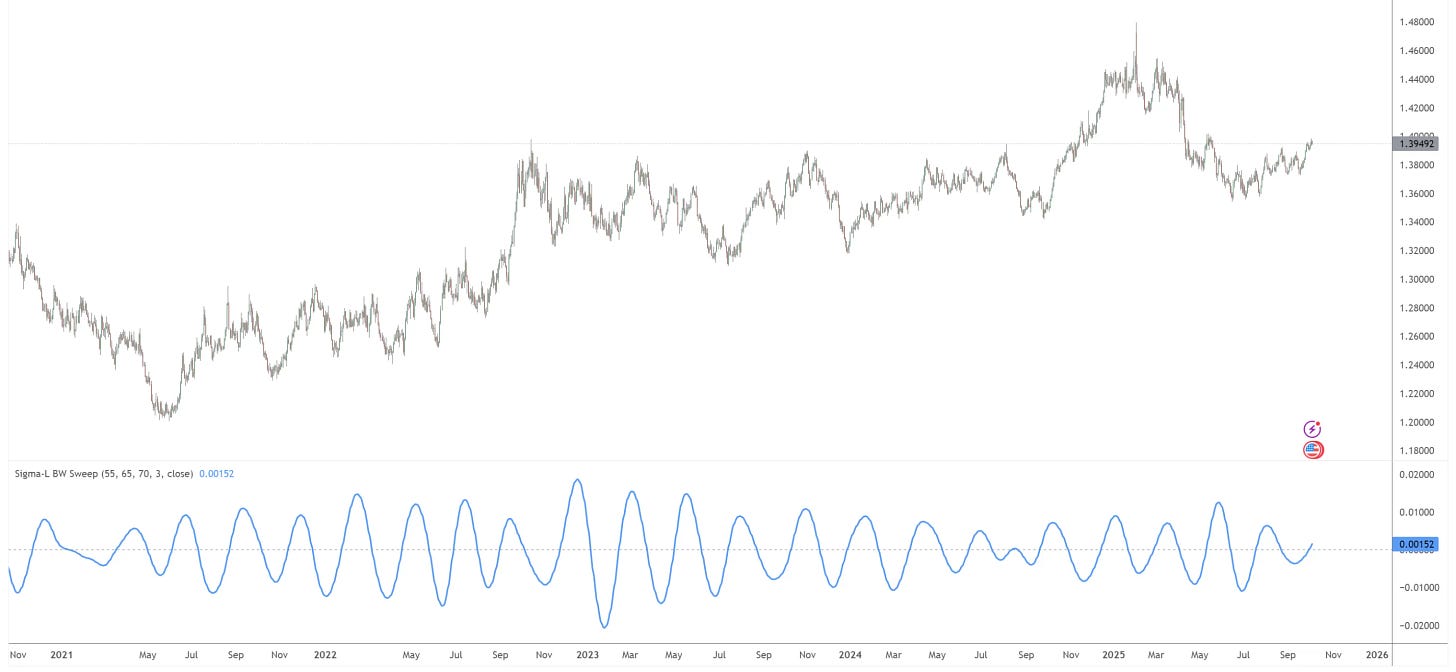

Free! Tradingview Indicator: 3-Pole Butterworth Bandpass Filter

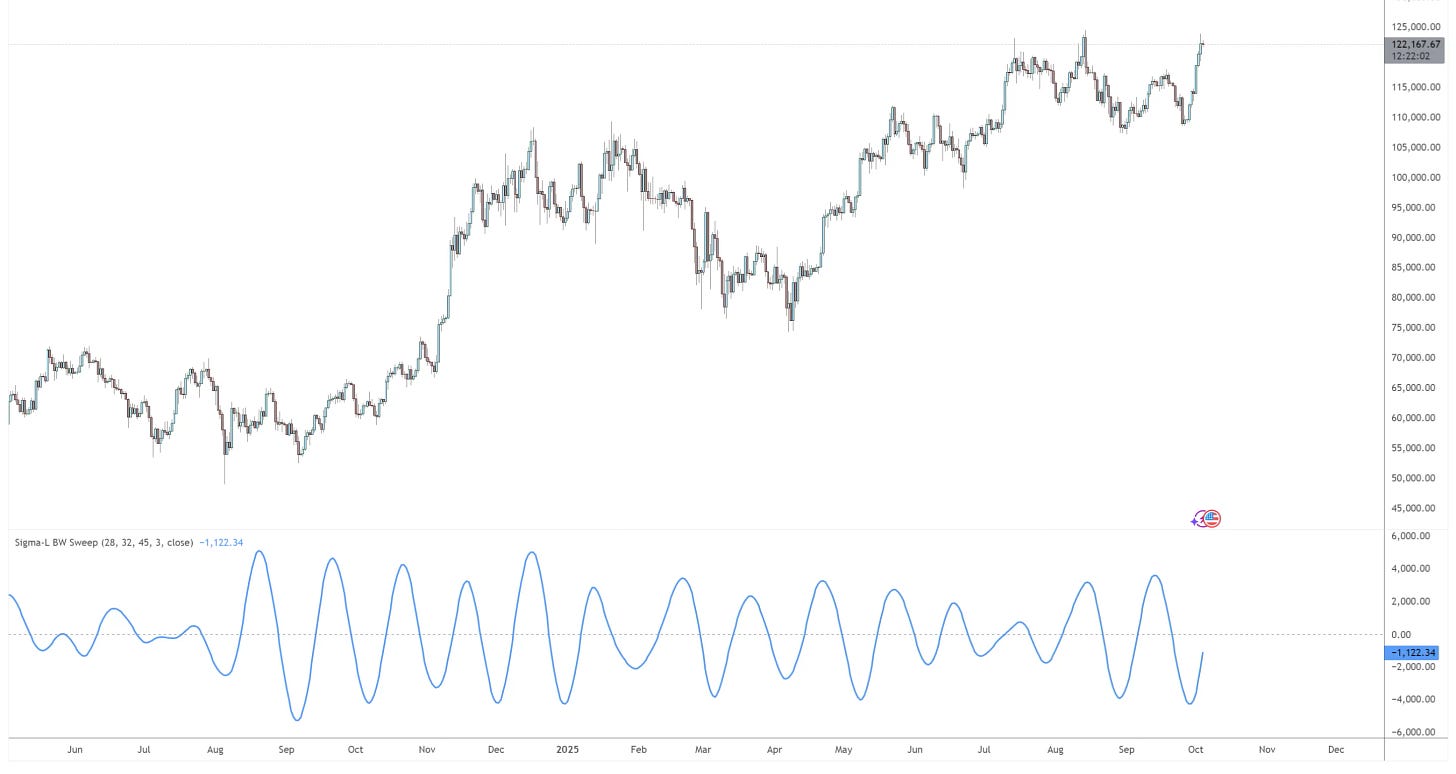

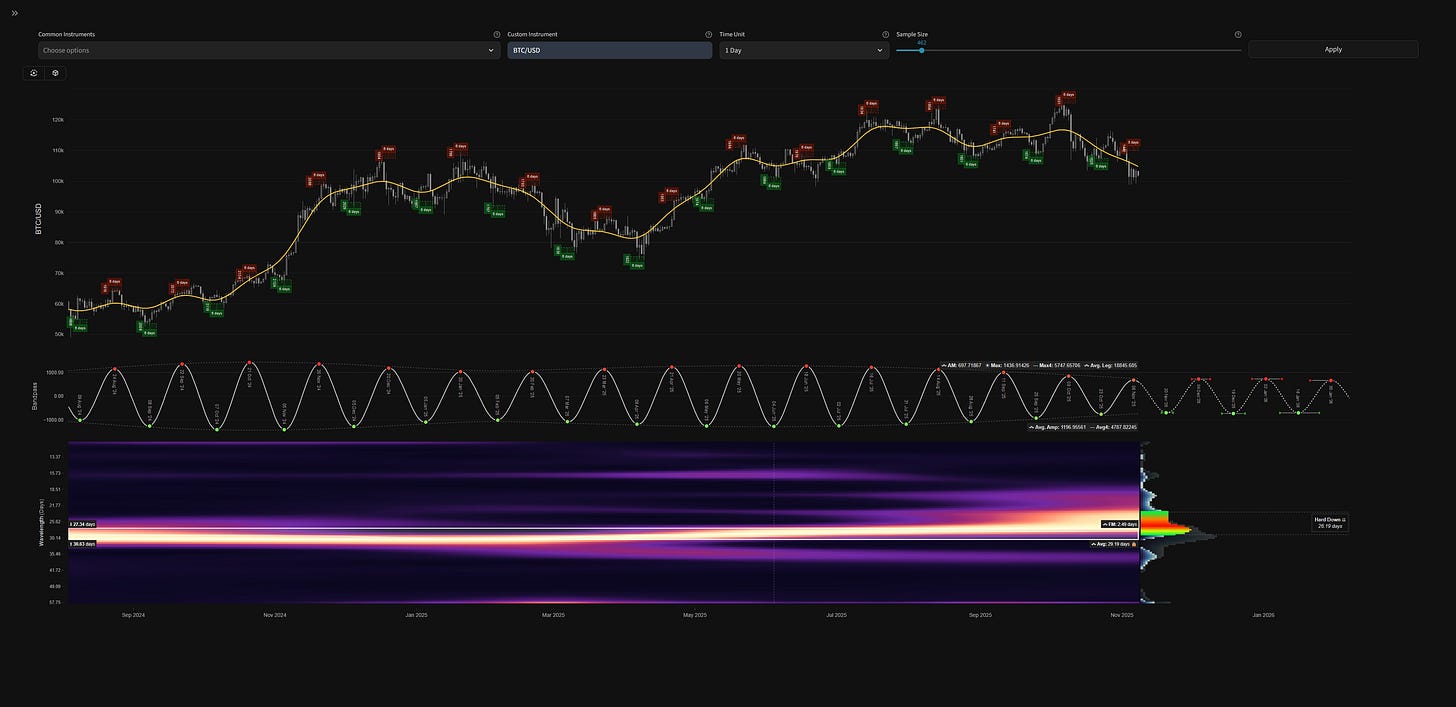

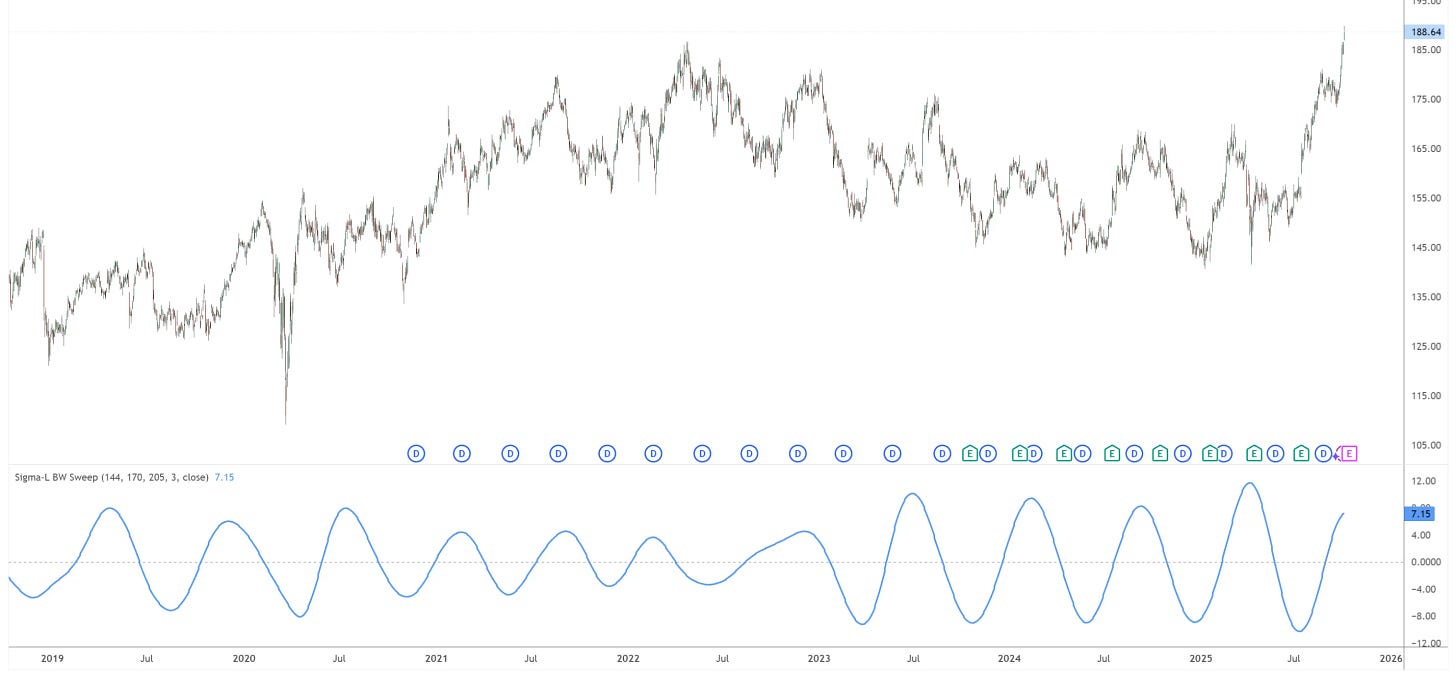

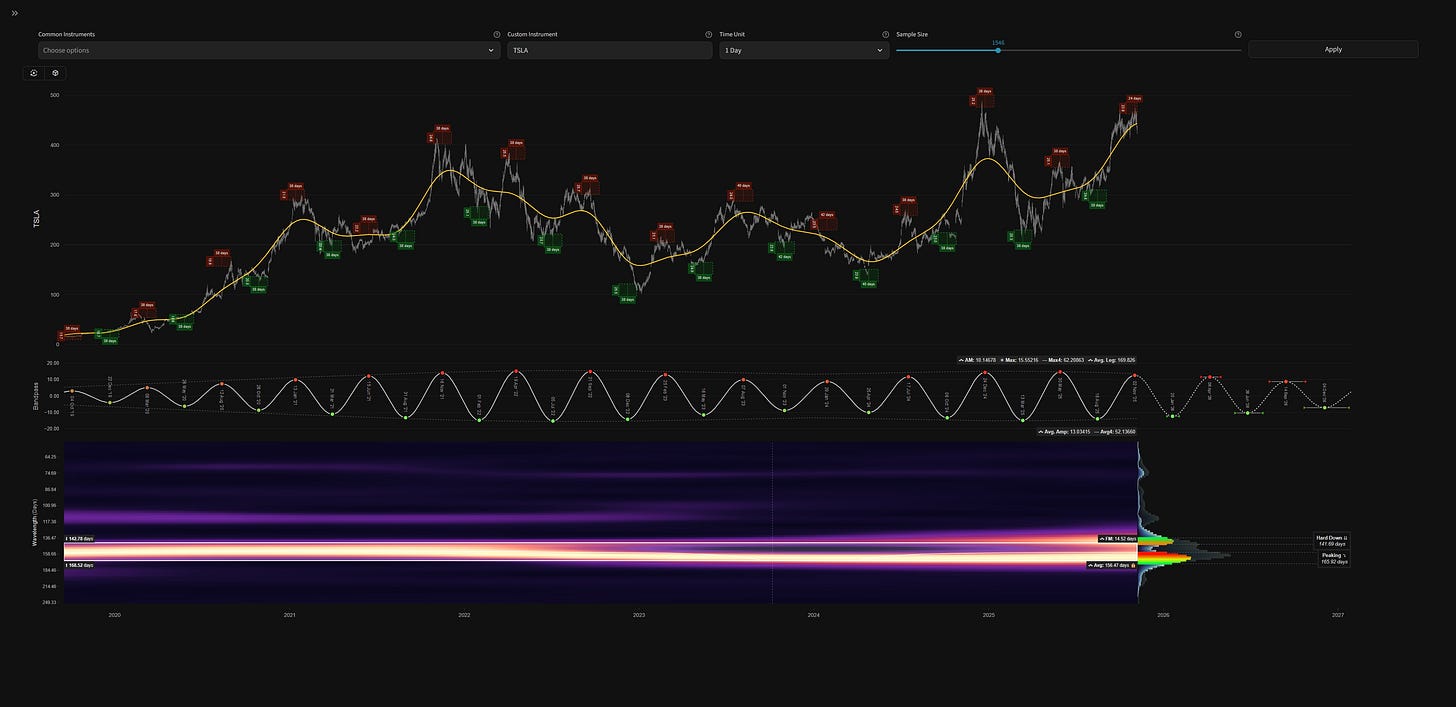

Add a 3 pole Butterworth band pass filter to your price series in Tradingview to help visualise cycles identified by our main time frequency analysis.

Although Tradingview’s pinescript language is, unfortunately, limited for the purpose of performing frequency domain analysis on market data, one can implement time domain filters to a decent degree, given some verbose coding (compared to optimal python/numpy/C and vectorisation).

Below is a fairly simple implementation of a Butterworth bandpass filter (on close prices) for your analysis pleasure. The price series is first detrended prior to filtering using a quadratic (order 2) or cubic (order 3) polynomial fit.

Copy and paste the code into the Tradingview code area to use on your charts, remembering to configure the upper and lower bounds of the filter (the cutoffs) according to your desired cycle target.

It is important to consider when configuring the cutoffs that Tradingview does not interpolate for weekends / holidays as we do in the main time frequency analysis. Therefore cycles identified in the main time frequency analysis will be slightly longer than the cutoffs needed for this Butterworth filter. I recommened experimenting yourself to discover the best parameters for optimal correlation to the time frequency result.

//@version=6

indicator(”Sigma-L BW Sweep”, overlay=false)

// Inputs

low_per = input.int(40, “Low Cutoff Period”, minval=10)

high_per = input.int(80, “High Cutoff Period”, minval=10)

filter_length = input.int(100, “Number of Bars for Filter/Detrend”, minval=20)

detrend_order = input.int(2, “Detrend Order (2 or 3)”, minval=1, maxval=3)

src = input.source(close, “Source”)

// Polynomial Detrend Function (least squares fit for order 2 or 3)

poly_detrend(src_in, len, order) =>

if len <= order

src_in

else

n = len

x_mean = (n - 1) / 2.0

sum_y = 0.0

sum_z_y = 0.0

sum_z2_y = 0.0

sum_z3_y = 0.0

sum_z2 = 0.0

sum_z4 = 0.0

sum_z6 = 0.0

for i = 0 to n - 1

xi = float(n - 1 - i)

zi = xi - x_mean

yi = src_in[i]

sum_y += yi

sum_z_y += zi * yi

sum_z2_y += zi * zi * yi

sum_z2 += zi * zi

sum_z4 += zi * zi * zi * zi

sum_z3_y += zi * zi * zi * yi

sum_z6 += zi * zi * zi * zi * zi * zi

y_mean = sum_y / n

denom_even = sum_z4 - sum_z2 * sum_z2 / n

b2 = (sum_z2_y - y_mean * sum_z2) / denom_even

b0 = y_mean - (sum_z2 / n) * b2

b1 = 0.0

b3 = 0.0

z_current = float(n - 1) - x_mean

if order == 2

b1 := sum_z_y / sum_z2

else

det = sum_z2 * sum_z6 - sum_z4 * sum_z4

b1 := (sum_z6 * sum_z_y - sum_z4 * sum_z3_y) / det

b3 := (sum_z2 * sum_z3_y - sum_z4 * sum_z_y) / det

trend = b0 + b1 * z_current + b2 * z_current * z_current + b3 * z_current * z_current * z_current

src_in - trend

// Detrended source

detrended_src = poly_detrend(src, filter_length, detrend_order)

// 3-Pole Butterworth Low-Pass Function

butterLP(src_in, len_in) =>

cf = 2 * math.tan(math.pi / len_in)

cf2 = cf * cf

cf3 = cf2 * cf

a0 = 8 + 8 * cf + 4 * cf2 + cf3

a1 = -24 - 8 * cf + 4 * cf2 + 3 * cf3

a2 = 24 - 8 * cf - 4 * cf2 + 3 * cf3

a3 = -8 + 8 * cf - 4 * cf2 + cf3

c = cf3 / a0

d0 = -a1 / a0

d1 = -a2 / a0

d2 = -a3 / a0

out = 0.0

out := nz(c * (src_in + src_in[3]) + 3 * c * (src_in[1] + src_in[2]) + d0 * out[1] + d1 * out[2] + d2 * out[3], src_in)

out

// Band-Pass on detrended series: High-Pass (detrended - LP(high_per)) then LP(low_per)

lp_high = butterLP(detrended_src, high_per)

hp = detrended_src - lp_high

bp_full = butterLP(hp, low_per)

// Plot in indicator window

plot(bp_full, “Butterworth Band-Pass (Detrended)”, color=color.blue, linewidth=2)

hline(0, “Zero Line”, color=color.gray, linestyle=hline.style_dashed)

The Cycle Hunt is On

If, in the course of using this indicator, you discover what you believe to be a metronomic signal (mostly stationary amplitude and frequency!), please let me know so I can run the TFA across it and share it to subscribers. Many pairs of eyes are better than one!

Thanks in advance.

David