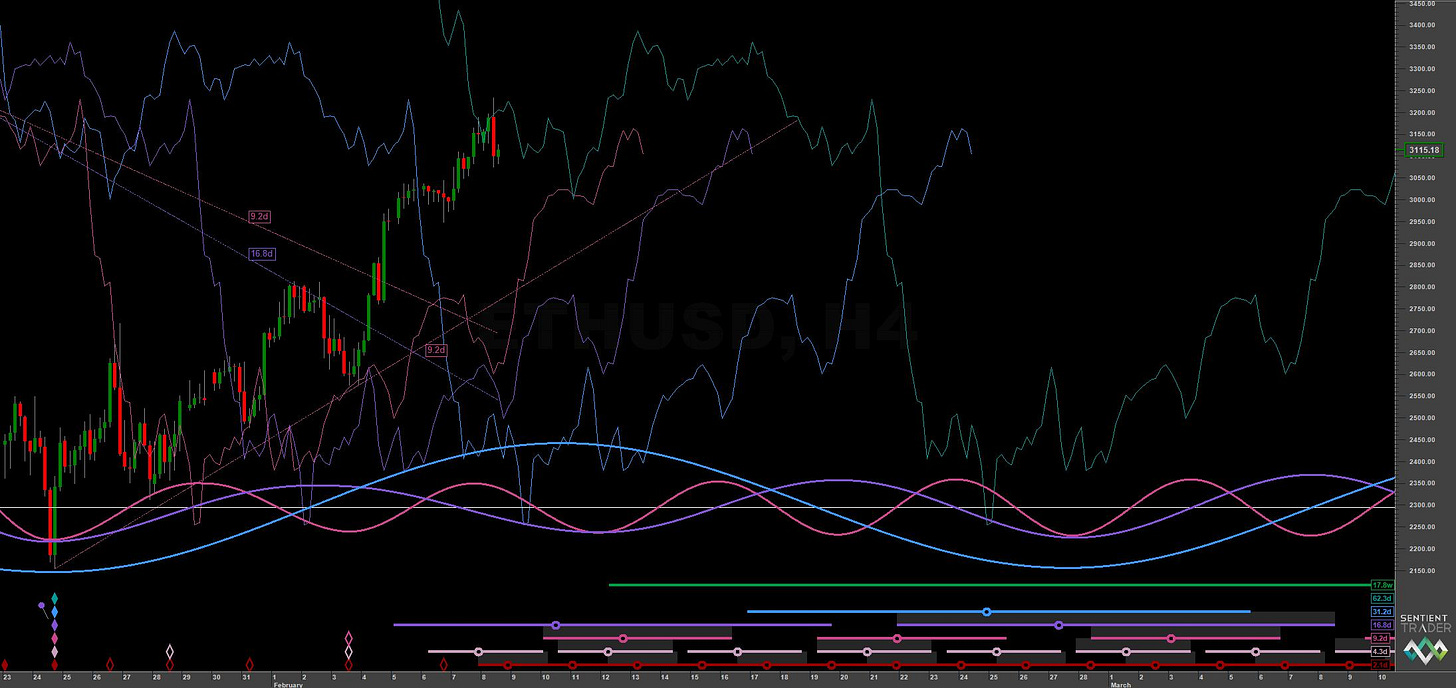

Ethereum: Hurst Cycles - 8th Feb 2022

ETHUSD | Phasing Analysis Update, Outlook & Trading Strategy

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality

Phasing Analysis

Long Term

Components greater than and including the 18 month nominal cycle

Medium Term

Components less than and including the 18 month nominal cycle

Short Term

Components around the 80 day nominal cycle

Summary

The last report into ETHUSD speculated that a low of 40 day nominal magnitude was occuring around the 7th/8th of January and also noted the waning bullish underlying trend.

From our last report:

The next 80 day nominal low is due at the start of February, the move to which should begin in the next couple of weeks once this 40 day component has rolled over. Traders may wish to wait for that, or indeed simply rotate to fiat until the 40 week nominal low in March/April.

The waning continued to increase as price failed to reach our target of 3600 from the proposed 40 day nominal low, instead peaking at around 3400.