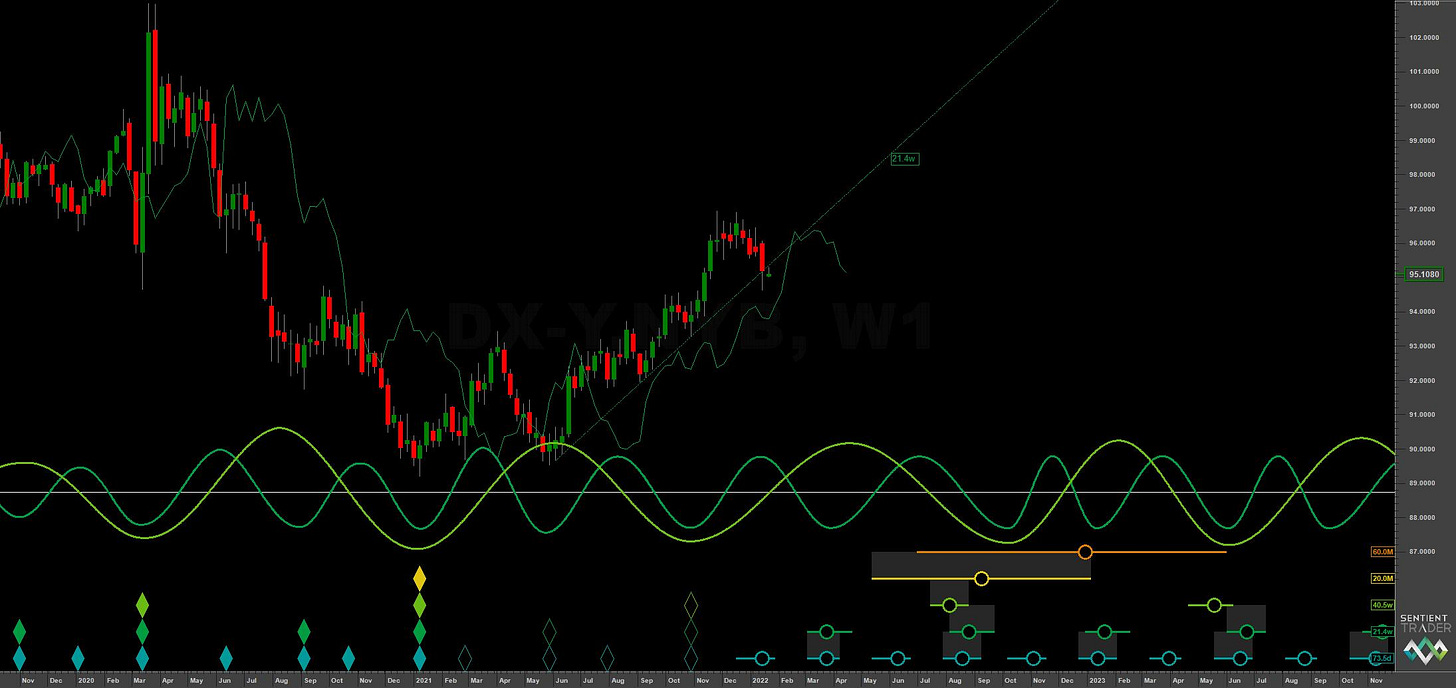

Dollar Index: Hurst Cycles - 17th Jan 2022

DXY | Phasing Analysis Update, Outlook & Trading Strategy

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced)

Phasing Analysis

Long Term

Components greater than and including the 18 month nominal cycle

Medium Term

Components less than and including the 18 month nominal cycle

Short Term

Components around the 80 day nominal cycle

Summary

The dollar index has confirmed it’s 18 month nominal peak via a cross of the 20 week upward VTL and moved down to the target of the 20 week FLD in the recent selloff over the last few weeks. The 80 day nominal low has (if phased correctly above) has come in slightly later than ‘the end of the year’ although certainly well within the threshold for the nest of lows.